The Poison Pill: EU Defence on US Terms?

17 Jul 2019

By Daniel Fiott for European Union Institute for Security Studies (EUISS)

This article was external pageoriginally publishedcall_made by the external pageEuropean Union Institute for Security Studies (EUISS)call_made in June 2019. external pageImagecall_made courtesy of Abby Richardson/Flickr.

Introduction

It took two letters. One, sent to Brussels on 1 May 2019 by two US undersecretaries, accused the EU of damaging transatlantic cooperation and hindering US access to Europe’s defence market through the rules it plans to set for the participation of third states in the European Defence Fund (EDF) and Permanent Structured Cooperation (PESCO). The other, sent to Washington on 16 May 2019 by senior EU officials of equal standing, refuted these claims by showing the objective and transparent way in which the EU had established the EDF and PESCO.

Unlike the letter from Washington, which was laced with robust language and questionable accusations, the EU response argued that, even with the introduction of the two initiatives, the European defence market would remain more open than that of the US. The EU institutions also stated that by creating the EDF and PESCO, the Union was showing its collective determination to reduce European capability duplication and enhance interoperability, while also ensuring the competitiveness of Europe’s defence industry. In essence, the EU pointed out that its security and defence initiatives are designed to contribute to transatlantic burden sharing – something the US has been requesting from European allies for some time.

Summary

- The US government has no grounds to accuse the EU of constructing a ‘fortress Europe’ to protect European defence markets. The US has a privileged position in European defence markets, even though the US government’s discretionary power disincentivises European business in the US market.

- The US should champion EU efforts to reduce market fragmentation, develop high-tech defence capabilities and become a more capable and responsible partner for the US and NATO. However, it should recognise that the EU has its own security interests, too.

- US concerns about the EDF and PESCO reflect Washington’s fear about technology proliferation, its long-term industrial competitiveness vis-à-vis China and internal politics within the Trump administration.

- One lesson that can be drawn from the US’ concerns is that the EU’s defence industrial fragmentation reduces the Union’s bargaining power vis-à-vis Washington. This leaves the EU exposed to a divide and rule strategy.

While the US welcomes that the Fund allows for the participation of third states, it objects to the fact that recipients and subcontractors supported by the EDF will not be permitted to transfer sensitive information and/or Intellectual Property Rights (IPRs) outside of the EU.1 Additionally, the US fears that the unanimity principle governing PESCO could ensure that any future US participation in the initiative could be vetoed by a single EU member state. At the core of Washington’s fears is the idea that EDF and PESCO could lock US firms out of the European market. However, the EU has made it clear that the EDF and PESCO will not alter EU defence procurement rules, lead to EU-owned defence capabilities, affect bilateral defence agreements between the US and individual member states and/or harm NATO defence planning targets and processes. Furthermore, given the US’ own long-standing and legitimate protection of its core defence industrial interests, there is a certain irony to its accusations of the EU because the Union has equally legitimate security interests.

Following the exchange of letters between the partners, a number of questions have surfaced. First, despite a sustained campaign of influencing the EU to adopt favourable conditions for the US,2 why has Washington raised tensions with the Union now? Second, given that €13 billion has been earmarked under the EDF, and its own defence budget stood at $650 billion in 2018, why is the US so concerned? With a view to answering these questions, this Brief begins with an analysis of US government data that shows the asymmetry between US and EU defence markets. It then moves on to a discussion about a web of regulations and laws which effectively provides the US government with the discretionary power to control its defence market and technologies. The Brief ends with some reflections on why the US has decided to formally raise objections about the EDF and PESCO now and the deeper reasons underlying American concerns.

Some Numbers Don’t Lie…

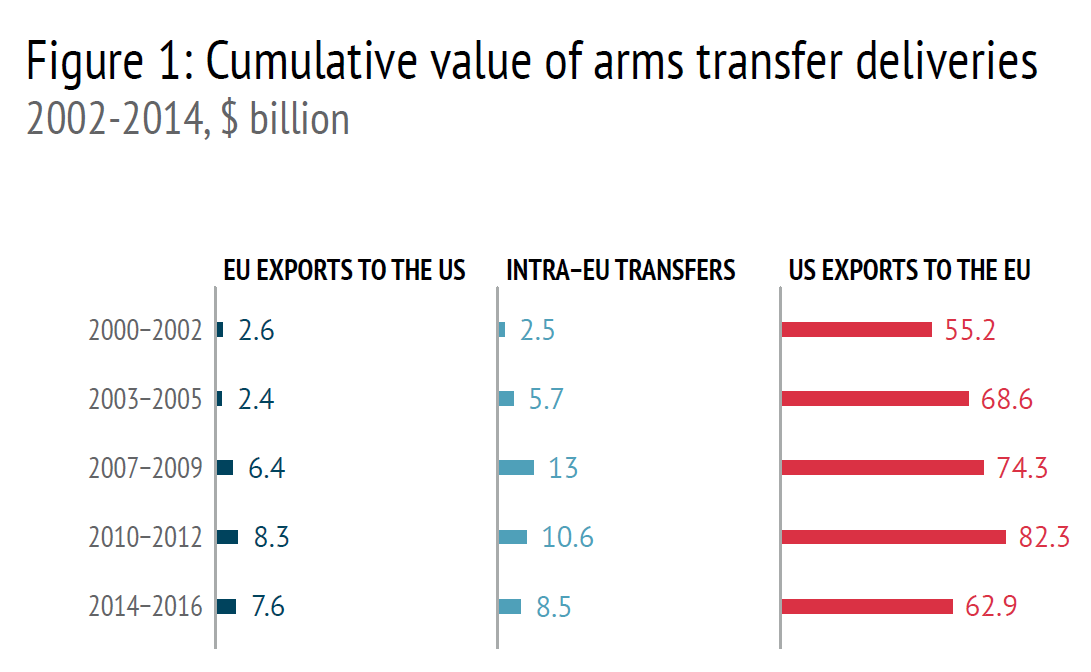

US fears that the EDF and PESCO could discriminate against US defence firms operating in the EU are overblown when seen through the prism of existing data on transatlantic trade in arms, components and services. In fact, the US government’s own data tells a familiar story: the US exports more to the EU market than the Union exports to the US. As Figure 1 indicates, the US Department of State estimates that from 2014 to 2016 the US exported $62.9 billion worth of defence exports to the EU versus $7.6 billion from the Union to the US. This was not an exceptional occurrence: the US has consistently exported more to the EU than vice-versa.3 Notwithstanding questions about the accuracy of US government data4, the figures show us that US defence firms are extremely competitive in the European defence market and that European firms are not as competitive in the US.

However, the numbers also tell us that the EU defence market is considerably more open than the US. This seems likely to continue to be the case for some time even with the EDF and PESCO because they do not alter the nature of EU defence procurement law. In 2009, the EU adopted two directives on defence transfers (2009/43/EC) and procurement (2009/81/EC) in order to reduce the costs of cross-border sales and to ensure non-discrimination when defence contracts were being awarded in the EU. Even with these laws, however, the US enjoys unparalleled access to the European defence market because the directives do not apply to joint programmes or government-to-government sales5 and they allow ‘member states to pursue and further develop intergovernmental cooperation’.6 Not only have the directives enhanced the transparency of defence procurement in Europe,7 but they have benefitted US firms in the process.

Data derived from contract award notices under Directive 2009/81/EC shows that US firms profited from the EU’s defence procurement rules. From 2011 to 2015, the total value of contracts awarded directly to foreign firms under the Directive was €3.1 billion out of a total €30.36 billion (or 4% of total contract notices).8 Indirect cross-border transactions under the Directive accounted for 40% (or €12.44 billion) of all contracts from 2011 to 2015 and US suppliers hoovered up 81% (or €10 billion) of these contract awards.9 Although this figure contains a single contract worth £6 billion awarded by the UK to US industry in 2015,10 subtracting this single award would still leave the US with a share of 44% (or €5.5 billion) of indirect transactions in EU defence procurement.11 It is for this reason that the US government recognises that the directives do not discriminate against its suppliers or constitute a ‘Buy European’ preference.12 This is an important admission because neither the EDF nor PESCO alter EU defence procurement law.

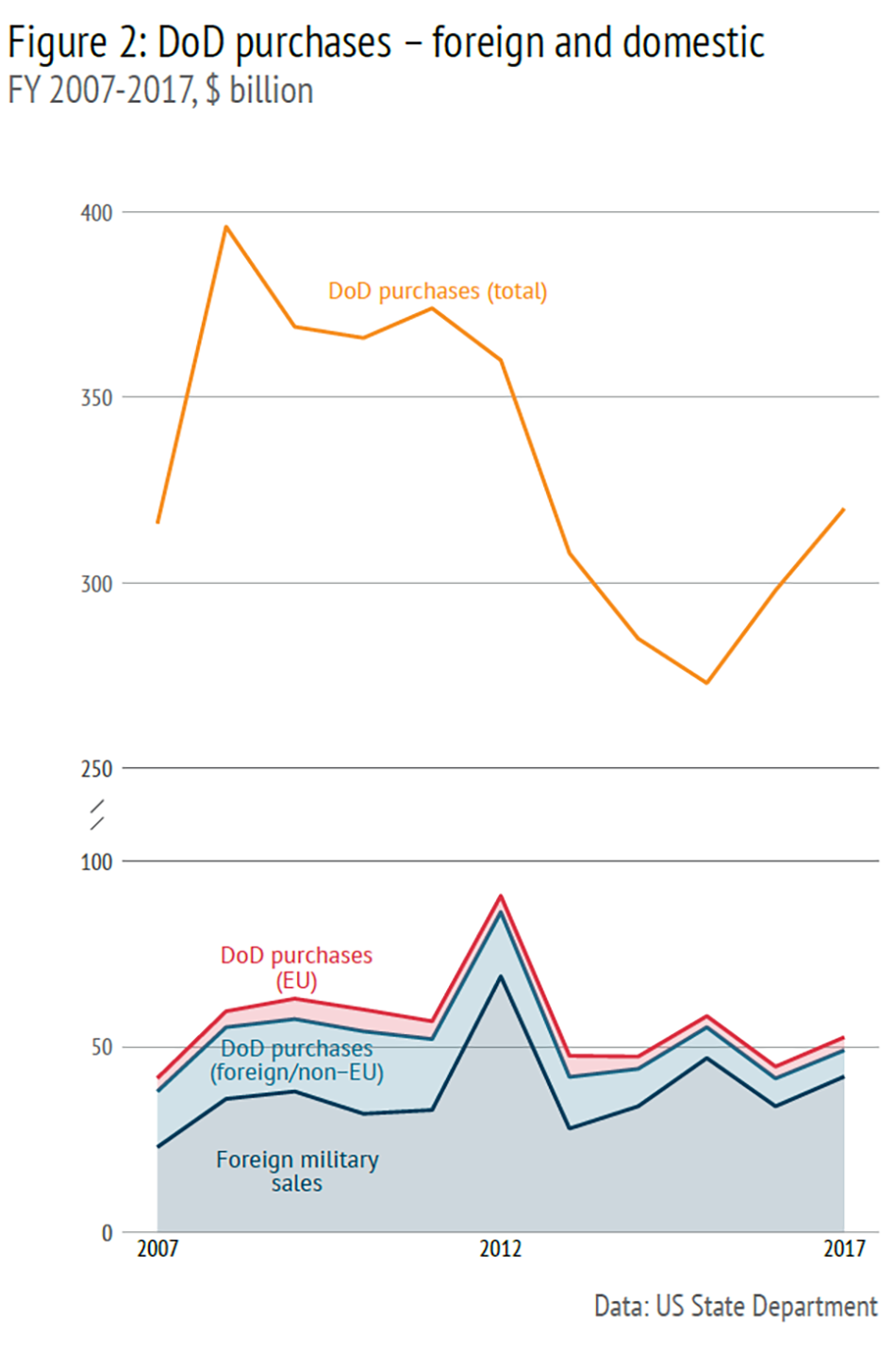

It is also possible to look at the claim that a substantial share of foreign purchases by the Department of Defence (DoD) make their way into the hands of European firms and governments. Each year, the DoD must report to the US Congress data pertaining to the purchases that the Department makes from foreign suppliers in any given fiscal year.13 The figures from 2007 to 2017 in Figure 2 reveal that EU member states have on average secured 35% of all purchases made by the DoD from foreign suppliers. However, this number has to be put in context. In fact, only an average of 6% of total DoD purchases were awarded to foreign suppliers per year over the ten year period in question. The EU secured an annual mean average of 1.4% of all DoD purchases from foreign suppliers from 2007 to 2017. Figure 2 also reveals that although foreign purchases by the DoD increased from 2007 to 2010, after this point foreign suppliers progressively decline as a share of overall DoD purchases. Interestingly, although the decrease in foreign supplier contracts can be attributed to a lower level of overall DoD purchases from 2008 to 2015, foreign supply contracts do not increase after 2015 when overall DoD purchases start to rise.

Another aspect of the data that needs consideration is how far foreign purchases by the DoD are offset by Foreign Military Sales (FMS). The FMS programme is authorised under the US Arms Export Control Act and it allows the US government to sell defence goods and services to preferred foreign countries – it usually also presumes that recipients will work closely with the US (e.g. training with US forces and exercises). Figure 2 indicates that from 2007 to 2017 FMS revenue has more than offset the DoD’s foreign purchases.14

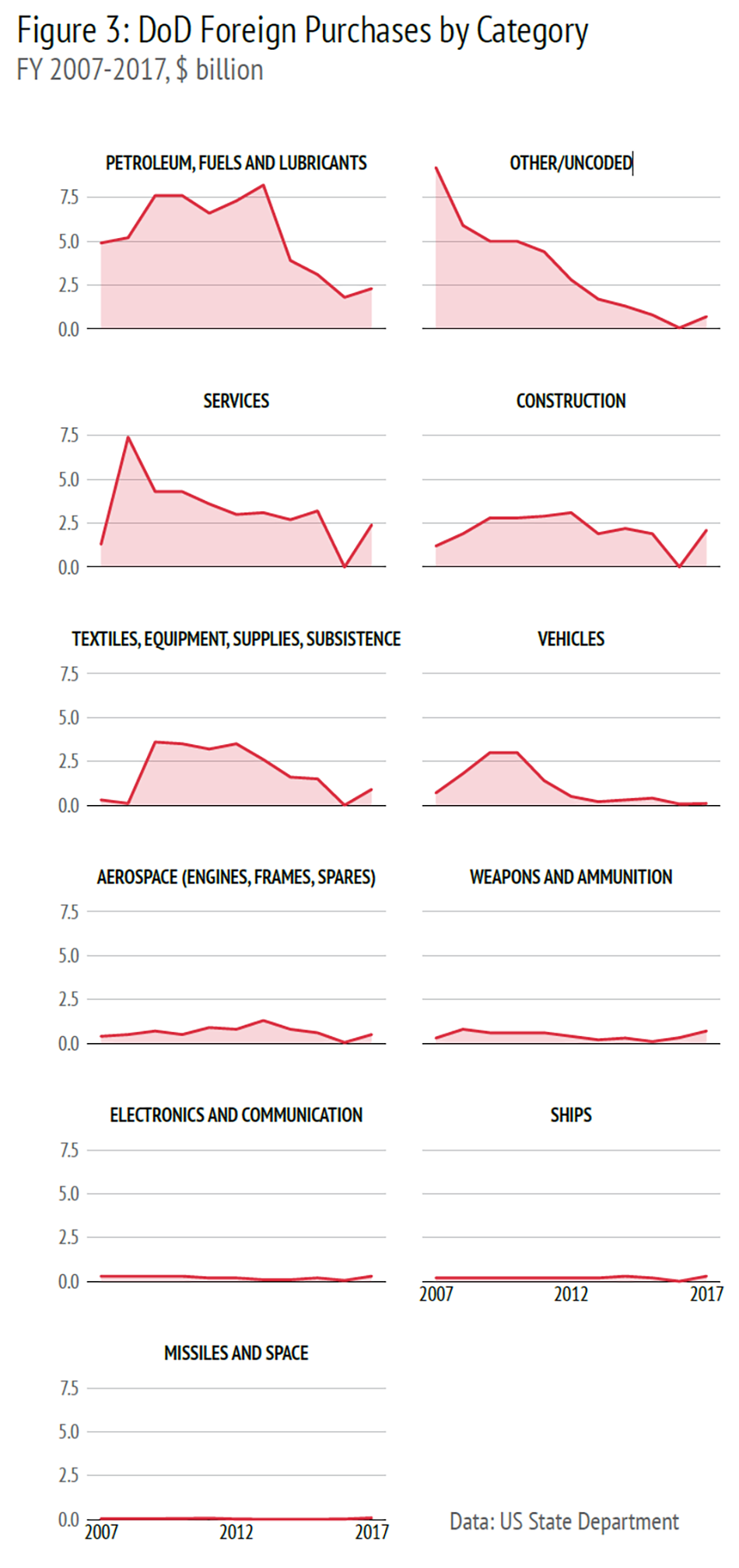

Furthermore, it is worth probing what type of goods and services the DoD purchased from foreign suppliers. As Figure 3 shows, from fiscal years 2007 to 2017 the DoD purchased $58.5 billion worth of petroleum, fuels and lubricants from foreign suppliers and this was followed by $35.3 billion in services, $22.8 billion in construction and $20.8 billion in textiles, equipment, supplies and subsistence. This highlights that the majority of foreign purchases by the DoD are geared to low-tech and subsistence goods and services. Interestingly, the high-tech areas that European defence firms specialise in comprise a smaller share of overall DoD foreign purchases. In fact, the US spent twice as much on petrol, fuels and lubricants from foreign suppliers than it did on the combined total of foreign purchases for high-tech goods such as missiles and space, ships, electronics and communication, weapons and ammunition, aerospace and combat and non-combat vehicles.

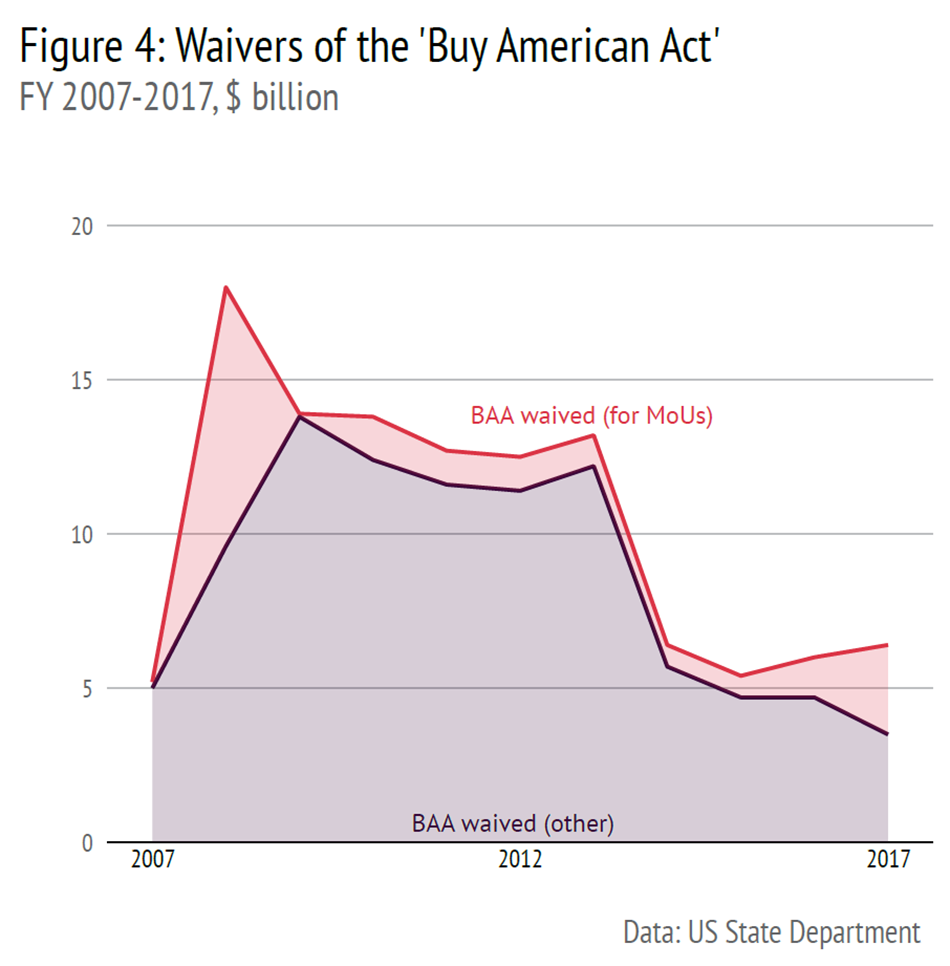

US government data on the volume of EU and US defence exports also suggests that the 19 Reciprocal Defence Procurement Memoranda of Understanding (RDP MoU) that the US maintains with EU member states15 have had a relatively minimal effect on European exports into the US. Although the RDP MoUs are supposed to primarily facilitate diplomatic exchanges on market access and procurement, they have not led to any tangible reform of US market access rules and regulations or served as an incentive for European governments and firms to export to the US market. What is more, the RDP MoUs are designed to facilitate the lowering of US national security barriers such as the ‘Buy American Act’ (BAA), but lowering these barriers depends on the US’ application of the BAA and this in turn responds to the political objectives of the US government at any given time. As Figure 4 highlights, US data shows that BAA waivers have decreased since 2008.16 Following a presidential executive order on 18 April 2017 that called for a stricter interpretation of the BAA by US government departments and agencies, it does not seem likely that Europeans can bank on substantial waivers of the BAA for defence-related goods for the foreseeable future.17

In addition to the RDP MoUs, numbers supplied by the US Federal Procurement Data System (FPDS) highlight that European firms were still not as successful as US firms when it comes to winning US contracts in 2018. The FPDS data reveals that the top 100 contractors to the Pentagon in 2018 received a total of $229 billion, and of this amount approximately $213.4 billion (or 93%) went to US firms.18 The remaining $15.7 billion was awarded to 13 foreign suppliers: $3.6 billion was awarded to 5 companies from Australia, Canada, Qatar and the United Arab Emirates (UAE) and contracts worth $2.1 billion were awarded to European petrochemical companies BP and Shell and not defence firms. Additionally, six companies on the FPDS list are branded as ‘European’ defence firms because of their EU-based headquarters, but these firms can only win DoD contracts by developing and producing defence systems on US soil.

The FPDS data reveals a familiar and long-standing story about the US defence market. True, the US can say that it has awarded billions of US dollars to European firms over the years. It did so in June 2018 when its $1 billion Short-Range Air Defence System (IM-SHORAD) programme was partially awarded to US-based Leonardo DRS. In September 2018, Leonardo was again successful in a bid for the $2.38 billion contract to replace the US Air Force’s UH-1N ‘Huey’ helicopter. Even Belgian firm CMI Defence was included in a $650 million (2018-2022) programme to replace the Bradley Fighting Vehicle. Again, however, each one of these programmes involves US partners such as Boeing, General Dynamics and SAIC and European firms are usually given a smaller share and only part of the overall contract – additionally, when they do get a slice of a contract they nevertheless produce the goods on US soil and this is where the technology remains, too. Although European branded firms can count US-generated profits as part of their overall cash flow mix, the reality is that large US prime contractors are hand-picking European branded partners from a small pool of companies already based in the US.

A Web of Discretionary Power…

Quite apart from the quantitative evidence that shows that the European defence market is considerably more open than the US market, it is also worth considering the web of laws and regulations that gives Washington a high degree of discretionary power over the transfer of technologies out of the US. Such a level of power is understandable because the regulations are designed to safeguard US technologies and preserve its defence industrial base and military power. However, a consequence of pursuing such objectives is that the US defence market disincentivises European firms from bidding for DoD contracts. Sketching out this web of regulations is not an easy task, as most laws that provide the US government with its discretionary power were passed many decades ago. For example, the Defence Production Act (1950) allows presidential authorities to restrict the number of imported defence-related supplies on an annual basis if required and the ‘Berry Amendment’ (1952) requires that the DoD purchases textiles, clothing, footwear, food and tools from domestic suppliers.19

There are also political bodies which can restrict foreign investment in the US defence. For example, the interagency Committee on Foreign Investment in the United States (CFIUS) can prevent foreign entities from accessing critical military technology and expertise.20 CFIUS can also screen planned investments with a view to advising the US president on whether he or she should block a merger or investment. In the case of a foreign investment in the US defence market, the CFIUS can approve a company incorporation, sale or merger subject to certain criteria, including: it may have to forego bidding for sensitive defence contracts, it might be denied a security clearance or that ‘proxy boards’ made up entirely of US nationals (who are eligible for high-level clearances) could be appointed to manage the company on a daily basis when classified information is being handled. This, along with other regulations, has the effect of effectively creating a ‘Chinese wall’ or partition between the US-based European firm and its headquarters in Europe. In this respect, CFIUS sanctioned investments come with restrictions on what a European branded firm can achieve in the US, even more when the firm is a newcomer. It should be noted that on 13 August 2018, President Trump signed a new law reforming and expanding the jurisdiction of CFIUS to ensure greater control of investments into the US.21

However, perhaps the most notorious piece of legislation that gives the US discretionary power over defence exports is the International Traffic in Arms Regulations (ITAR). Starting with the State Department, a number of US government departments and agencies are involved in ITAR and it is designed to restrict technology, data and knowledge transfers out of the US with a view to controlling proliferation and to ensure that the US secures its technological edge in line with goods and technologies listed on the US Munitions List (USML). It is understandable why the US would want to control exports of technology, but ITAR serves as a disincentive to access the US defence market. Only few firms, if any, would risk investing in fundamental research, a technology or system in the US only to then have the exportation of that investment controlled by the US government – this is especially the case given that ITAR violations come with hefty fines and/or danger of imprisonment. In this sense, the ITAR serves as a sort of ‘non-return valve’ whereby foreign firms can theoretically access the US market but only at the risk of their knowledge, data and technologies being confined to US territory. This risk is heightened because the US government can strategically pick and choose which knowledge and technologies to target with ITAR by amending the USML.

Furthermore, the US government applies ITAR on an extraterritorial basis which means that it can even restrict the exportation of finished weapons systems, technologies and data that contain ITAR controlled technology and software anywhere in the world. Accordingly, ITAR can be used to control defence exports between two or more states (even when none of these states is the US). ITAR also applies to the control of knowledge such as technical data and software, so that even conversing about ITAR controlled technologies or emailing colleagues about it are considered to be ITAR ‘exports’. In reality, therefore, this means that the US government has the power to restrict defence exports between EU member states for certain defence technologies, something which is counter to the efforts the EU has taken to lower barriers to intra-EU transfers of defence equipment. Restrictions of this kind amount to losing full autonomy over the exportation and use of defence technologies because they contain US-produced technologies, material or software. Such restrictions are well-documented: for example, in early 2018 US authorities blocked the sale of additional French-made Rafale jet fighters to Egypt because the on-board Scalp cruise missile contained an American component.22 This situation is encouraging EU member states to develop and/or incorporate non-US or ‘ITAR free’ technologies and components into their weapons systems programmes, but this depends on replacement technologies and governments having the resources to develop and procure an alternative option. Furthermore, ITAR controls may also negatively affect supply chain management and maintenance, repair and overhaul (MRO) contracts by giving the US government control over security of supply.

In addition to ITAR, however, access to the US defence market is further disincentivised when looking at US patent controls. Patents are designed to protect the inventors of a technology by excluding others from developing or commercialising a particular technology. In the US, patents that are developed for defence fall under the discretionary power of the US government. The US code on patents makes clear that the US government can issue a secrecy order for patents that it deems to be in the national security interest of the country. If a patent application, say by a foreign operator, is deemed by the US government to be detrimental to US national security, then the commissioner of patents can issue a secrecy order and withhold the application or granting ‘of a patent for such period as the national interest requires’.23 According to one source, at the end of 2018 there were 5,792 secrecy orders in effect in the US.24 There have been steps to alleviate this problem: for example, a defence firm can seek a right to compensation for the patent falling under the secrecy order25 and a number of bilateral26 and NATO27 agreements are in place to facilitate the exchange of patent rights and technical information for the purposes of defence. However, compensation for patents falling under the secrecy order rests on the US government’s discretion to award compensation or not.

A Question of Misunderstanding?

Clearly then, the European defence market is more open than the US but it is also true that the EU does not have the discretionary power enjoyed by the US government. The introduction of the EDF and PESCO will not change this situation. What is often lost on US officials is that when the EU crafts its defence initiatives, it does so by consensus including all of its member states and that with the EDF the Union must also respond to the democratic wishes of the European Parliament. In this sense, EU defence cooperation is not comparable to the US when it comes to the ease with which the US government can craft and enforce its market access rules. The EDF and PESCO do not stop the US from launching bilateral initiatives in Europe, either. For example, the US government has in the last few months launched the $190 million European Recapitalisation Incentive Programme (ERIP), which subsidises US-made weapons and products for countries such as Croatia, Greece, Slovakia and some non- EU states. The ERIP is designed to ween Europeans off of legacy Soviet systems but it is also a subsidy to US industry. Should the US seek to ramp up the ERIP because of the EDF or PESCO, then EU member states will have a choice between potentially (but not always) cheaper, off-the-shelf products from the US or EU processes that support the long-term development of their own defence capabilities and industries and help to safeguard European technological innovations along the way.

Accordingly, the EDF and PESCO are geared to enhancing the EU’s defence capabilities, interoperability and industrial competitiveness, and as part of this ambition the Union seeks to protect its legitimate security interests. The EU shares the US’ view that technologies and intellectual property should be safeguarded and that taxpayers should not necessarily be expected to subsidise foreign suppliers. With these objectives in mind, the EU has been objective and transparent in its construction of the EDF and PESCO. Not only have senior EU officials regularly briefed NATO ministers and the North Atlantic Council on the continued development of the EDF and PESCO, but the EU’s defence capability prioritisation processes also take into account the NATO Defence Planning Process (NDPP). Given that NATO has not led to any radical defragmentation of the European defence market in its 70-year history, the EU is answering the repeated calls by the US government to reinforce Europe’s contribution to NATO.

Given the openness of the EU defence market and the steps the Union has taken to reach out to NATO, it is perhaps worth exploring why the US government has moved so stridently against these two initiatives recently. Starting with a historical perspective, it can be argued that there is nothing new about the US’ approach to new and ambitious EU projects.28 Indeed, former Deputy Secretary of Defence Paul Wolfowitz raised objections about the EU’s Galileo global navigation satellite system (GNSS) programme in December 2001. At the time, Wolfowitz sent letters to European capitals stating that Galileo would affect future NATO operations and he asked that European colleagues work with the US to block the programme through the Council of the EU.29 But look at Galileo today: it has not threatened NATO in any way and US authorities have even granted Galileo access to the US civil market. US fears about the EDF and PESCO could therefore simply be an opportunistic tactic to see if Europeans jump when Washington shouts.

One other explanation for the US’ concerns might be timing. The US understands that the EDF still needs to be approved by a new European Parliament after the summer, and by vocally raising its concerns it may hope to influence the Parliament’s final deliberations on the Fund. Additionally, Washington sees a window of opportunity to plead bilaterally with member states before an agreement is reached on third-state access to PESCO in the Council of the EU. Another possible issue related to timing stems from US domestic politics. For example, Patrick Shanahan assumed the role of acting secretary of defence in January 2019 and he is still awaiting final confirmation as secretary of defence by the US Senate. It could be that Shanahan – a man that worked for US aerospace giant Boeing for 31 years – is pushing the Europeans on defence industrial issues as a way to enhance his political credentials in the Republican-dominated Senate.

Beyond the timing of the US letter to the EU, however, there is a need to understand some of the deeper motivations behind it. First, fears about the EDF and PESCO should not be disassociated with planned future development programmes. While it is still too early to tell if the planned Franco-German-Spanish Future Combat Aircraft System (FCAS) might benefit from the EDF or be considered a PESCO project, the development of a sixth generation combat aircraft, unmanned aerial vehicles (UAVs) and satellite systems represent industrial competition to the US’ market dominance. Although the FCAS is still in the initial stages of R&D, and there are questions about whether European partners can agree on common export policies, the US appears to be hedging against this development by encouraging the EU to amend the proposed EDF Regulation on its terms.

Yet any amendment to the proposed EDF Regulation that would allow US firms to transfer EU-funded technologies and IPRs out of the Union could come with risks. Doing so could ensure that EU-funded defence technologies, components and software would fall under ITAR, for example. Under these circumstances, there would be no incentive to seek EDF support for FCAS for fear that the US would use the extraterritoriality of ITAR and US discretionary power to control FCAS technologies (i.e. by denying exports of future European aircraft) and thus potentially hampering the programme as a whole for the benefit of its own future fighter aircraft programmes. Clearly, there is a reason why some European states would want to keep future defence development programmes as ‘ITAR free’ as possible.

Concerns about the EDF, PESCO and future EU defence capability programmes are symptomatic of broader American concerns about the competitiveness of its defence industry, the endurance of its military edge and the steps taken towards strategic autonomy in Europe. Recent US efforts to maintain its military edge vis-à-vis China, and to stem the global proliferation of sophisticated technologies, are intimately linked to US defence industrial strategy in Europe (and Japan). Looking to the future, the US wants to maintain its privileged position in foreign defence markets as a strategic buffer against the rise of China. Not only are allies and partners good sources of revenue for American defence firms, but they can be harvested for innovative technologies, too. In this sense, Europe may be seen more as a market place to mine technological nuggets rather than as a genuine technology partner. Washington says it wants to bring Europeans along on its quest to develop technologies such as robotics, lasers and Artificial Intelligence (AI) but only in line with its own military strategy and strategic assumptions. Through this prism, the EDF and PESCO could be seen as obstacles to US industrial and strategic goals because they promote EU defence industrial competitiveness and allow the Union to devote its limited – albeit growing – resources to its own defence capabilities and priorities.

What is more, it is possible that the US is hedging against China’s future arms export strategy. Although China is already one of the leading global arms exporters (it exported arms to 53 countries from 2014- 2018),30 for now it is intensely focused on developing its indigenous industrial base and defence capabilities. Presently, exports are mainly geared to shipments of small arms and light weapons and ammunition, but it is already entering niche markets such as UAVs. In time, the value and technological sophistication of Chinese defence exports could grow to perhaps rival and gnaw at the US’ global competitiveness and military superiority. Moves to ‘lock-down’ the European defence market by calling on governments to open up the EDF and PESCO to US firms could therefore be read as a critical component of Washington’s long-term strategy towards China.

If this is the case, the Union has to think through its own long-term defence industry strategy. The truth is that the US has the legitimate right to protect its technologies and there is a clear rationale behind the steps Washington takes – however distasteful for European industry – to ensure that technologies do not proliferate and support US military supremacy in the way it has been framed in numerous US National Security Strategies over successive years. But by this same logic, EU member states also have a legitimate right to support European industry and to ensure that the Union is able to operate at an adequate level of strategic autonomy. Ensuring that key technologies developed with European taxpayers’ contributions benefit the Union is one of the building blocks of a strong and efficient defence industrial base. This ultimately supports operational credibility, effective defence capabilities, defence innovation and high-skilled jobs. Yet, if the recent letter from the US has provided a lesson it is that the EU cannot presently negotiate greater US market access because its own market is still far too fragmented. If given the space to grow, in time the EDF and PESCO should remedy this, as well as enhance the military credibility and defence capabilities of EU member states.

References

1 See Article 10 in European Commission, “A Proposal for a Regulation establishing the European Defence Fund”, COM(2018) 476 final, Brussels, June 13, 2018.

2 American industry moved early to influence the EDF Regulation. See: American Chamber of Commerce to the EU, “The European Defence Action Plan: Challenges and Perspectives for a Genuine Transatlantic Defence and Industrial Relationship”, February 5, 2018, http://www.amchameu.eu/system/files/position_papers/final_website_edap_with_recommendations.pdf.

3 For all data included in Figure 1 see: US Department of State, “World Military Expenditures and Arms Transfers”, https://www.state. gov/world-military-expenditures-and-arms-transfers/.

4 The World Military Expenditures and Arms Transfers (WMEAT) values are based on estimates provided by a range of US government departments, agencies and bureaux. By the State Department’s own admission, the WMEAT data can be incomplete or ambiguous. Details on the methodology employed can be found here: US Department of State, “Sources, Data and Methods of WMEAT 2018”, p. 13, https:// www.state.gov/wp-content/uploads/2019/05/WMEAT-2018-Sources- Data-and-Methods.pdf.

5 See Article 13.f. of Directive 2009/81/EC of July 13, 2009.

6 See Article 4.1. of Directive 2009/43/EC of May 6, 2009.

7 This point was recently emphasised by the European Commission. See: European Commission, “Commission notice on guidance on cooperative procurement in the fields of defence and security (Defence and Security Procurement Directive 2009/81/EC)”, 2019/C 157/01, Brussels, May 8, 2019.

8 European Commission, “Commission Staff Working Document: Evaluation of Directive 2009/81/EC on Public Procurement in the Fields of Defence and Security”, SWD(2016) 407 final, Brussels, November 30, 2016, p. 59.

9 ‘Direct’ transactions are defined as those where a firm operating from its home market bids and wins a contract launched in another member states. ‘Indirect’ transactions are those where a foreign subsidiary firm can bid for contracts in a country that is different to the firm’s home country or where its headquarters or parent company is located. Ibid., “Evaluation of Directive 2009/81/EC”, p. 58.

10 European Union, “United Kingdom – Bristol: Defence Services”, Tenders Electronic Daily, May 9, 2015, https://ted.europa.eu/ udl?uri=TED:NOTICE:162335-2015:TEXT:EN:HTML&src=0.

11 Op.Cit., “Commission Staff Working Document”.

12 US Department of Commerce, “European Union: Defense Procurement Directive”, 2017, https://build.export.gov/build/ idcplg?IdcService=DOWNLOAD_PUBLIC_FILE&RevisionSelectionM ethod=Latest&dDocName=eg_eu_127661.

13 US Department of Defence, “DoD Purchases from Foreign Entities (FY2004-FY2017)”, https://www.acq.osd.mil/dpap/cpic/cp/DoD_purchases_from_foreign_entities.html.

14 All figures for FMS are taken from the US Government Accountability Office, “Foreign Military Sales: Control Should be Strengthened to Address Substantial Growth in Overhead Account Balances”, Report to Congressional Committees, GAO-18-401, May 2018, p. 7, https://www.gao.gov/assets/700/692484.pdf.

15 Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Italy, Latvia, Luxembourg, Netherlands, Poland, Portugal, Slovenia, Spain, Sweden and the UK. See:

https://www.acq.osd.mil/dpap/cpic/ic/reciprocal_procurement_ memoranda_of_understanding.html.

16 US Department of Defence, “Number of Purchases and Dollar Value of Manufactured Articles for which the Restrictions of the BAA were not Applied”, https://www.acq.osd.mil/dpap/cpic/cp/DoD_purchases_from_foreign_entities.html.

17 The White House, “Presidential Executive Order on Buy American and Hire American”, April 18, 2017, https://www.whitehouse.gov/ presidential-actions/presidential-executive-order-buy-american-hire-american/.

18 Federal Procurement Data System, “Top 100 Contractors Report – Fiscal Year 2018”, https://www.fpds.gov/fpdsng_cms/index.php/en/ reports/62-top-100-contractors-report.

19 Michaela D. Platzer, “Defense Primer: The Berry and Kissell Amendments”, Congressional Research Service, December 18, 2018, https://fas.org/sgp/crs/natsec/IF10609.pdf.

20 Office of the Secretary of Defense, “Committee on Foreign Investment in the United States (CFIUS)”, https://www.dtsa.mil/SitePages/ assessing-and-managing-risk/committee-on-foreign-investement-in-us.aspx.

21 US Department of the Treasury, “Summary of the Foreign Investment Risk Review Modernisation Act of 2018”, https://www.treasury. gov/resource-center/international/Documents/Summary-of-FIRRMA.pdf.

22 Pierre Tran, “A jet sale to Egypt is being blocked by a US regulation, and France is over it”, DefenseNews, August 1, 2018, https://www. defensenews.com/global/europe/2018/08/01/a-jet-sale-to-egypt-is-being-blocked-by-a-us-regulation-and-france-is-over-it/.

23 US Patent and Trademark Office, “115 Review of Applications for National Security and Property Rights Issues [R-07.2015]”, Department of Commerce, https://www.uspto.gov/web/offices/pac/mpep/s115. html.

24 Federation of American Scientists, “Invention Secrecy”, https:// fas.org/sgp/othergov/invention/index.html.

25 US Patent and Trademark Office, “35 USC 183 Right to Compensation”, Department of Commerce, https://www.uspto.gov/web/offices/ pac/mpep/mpep-9015-appx-l.html#d0e304585.

26 The US maintains bilateral patent agreements on defence with Australia, Belgium, Denmark, France, Germany, Greece, Italy, Japan, Korea, Netherlands, Norway, Spain, Sweden, Turkey and the United Kingdom. See: Op.Cit., “Invention Secrecy”.

27 NATO patent cooperation is framed by the “Agreement for the Mutual Safeguarding of Secrecy of Inventions Relating to Defence and for which Applications for Patents have been made”, September 21, 1960, https://fas.org/sgp/othergov/invention/nato60.pdf.

28 For example, the letter sent to the EU spoke of ‘poison pills’. A curious choice of words given that in corporate finance the expression is used to describe a company that wants to protect itself from a hostile take-over bid.

29 US Department of Defense, “Letter from Deputy Secretary of Defence Paul Wolfowitz to EU Ministers”, December 2001, https:// commons.wikimedia.org/wiki/File:Galileo_-_Wolfowitz_-_Letter.png.

30 Pieter D. Wezeman et al., “Trends in International Arms Transfers, 2018”, SIPRI Fact Sheet, March 2019, p. 5, https://www.sipri.org/sites/ default/files/2019-03/fs_1903_at_2018_0.pdf.

About the Author

Daniel Fiott is Security and Defence Editor at the external pageEuropean Union Institute for Security Studies (EUISS)call_made

For more information on issues and events that shape our world, please visit the CSS Blog Network or browse our Digital Library.