Brazil Leading by Example

4 May 2012

By Eliot Brockner for ISN

It was a momentous occasion, if not an immediately impactful piece of news. On the external page6th Marchcall_made, news reports confirmed that Brazil had surpassed the United Kingdom to become the world's sixth largest economy. The milestone confirms what Brazil watchers have been witnessing for years: sustained growth and a definitive marker of progress in an economy that seemed doomed to belong to the 'country of the future'. The news places Brazil into an elite category - only the US, Germany, Japan, China, and France have a higher Gross Domestic Product (GDP). It also strengthens arguments that leaders in Brazil have long been making: that Brazil is a global power and not simply a leader within South America.

Whether Brazil can lead Latin America is not a question of economic or political might. The country has long led South America in terms of population, GDP, commodity exports, and countless other categories. Instead, whether the Brazilian model can serve as a model for the rest of the continent is a matter of management and will. For leaders in Brasilia, the two big questions are whether Brazil can maintain strong diplomatic ties while deepening its influence across South America, and whether it wants to be seen as more than just a regional power.

Brazil Envy

In the first instance, Brazil currently finds itself in an enviable position. The country’s rise has coincided with the waning influence of South America's largest trading partner and most diplomatically influential neighbor: the United States. However, unlike the United States, Brazil is not generally regarded by South American states as an outsider and does not have the legacy of mistreatment that harms Washington’s diplomatic initiatives in the region. "Brazil doesn't have the same imperialistic connotations that the United States does", says Rachel Glickhouse, the author of external pageRio Gringacall_made, a blog that watches Brazil. "Initially, this makes [Brazilian-led development projects] more palatable and easier to sell, as there may be more trust."

In addition to trust, there is also admiration. Glickhouse also points to the phenomenon of external page'Brazil Envy'call_made that is sweeping political aspirants across Latin America, noting that countries as varied as Peru and the Dominican Republic are hiring Brazilian political consultants to replicate the success the country experienced the last decade. Accordingly, geography is currently working in Brazil's favor. Brasilia has been using its status across the region via multinational blocs such as UNASUR (Union of South American Nations) and MERCOSUR (Common Southern Market) as a vehicle to help sell Brazilian-run development projects.

And sell it has. Between 2001 and 2010, Brazilian investments in infrastructure projects in Latin America through the state-run Brazilian Development Bank (BNDES), grew 1,082 percent. Through BNDES, Brazil has more than USD 17 billion in projects across the region that form part of its worldwide portfolio of nearly external page900,000call_made projects. On March 19, Brazil and the Inter-American Development Bank external pageannouncedcall_made plans to create a USD 1 billion fund to support equity investments in Latin America. More such deals are likely over the next year, as external pageinvestors remain bullish on the countrycall_made in spite of increased competition.

BNDES, along with the World Bank, Inter-American Development Bank, and the Andean Development Bank (CAF), is one of four major lenders to development projects in Latin America. Unlike its peers, BNDES is unique in that it requires that Brazilian firms are contracted to undertake projects abroad. These projects, along with the United States’ waning influence in the region, have led some analysts to consider whether South America is turning into Brazil's 'backyard' further perpetuating (albeit indirectly) the belief that South America is a region prone to the influence of one strong regional power.

Outstanding Grievances

Yet Brazil's developmental expansion in the region has been far from seamless, and there have been several recent snags that compromise Brasilia’s reputation in some quarters. In Bolivia, for example, a controversial BNDES-backed highway through a external pagejungle reservecall_madehas led to numerous disruptive protests that have hurt Bolivian President Evo Morales' popularity and forced the president to delay construction of the road. Paraguay has long been seeking higher fees for energy generated by the Itaipu Dam that is eventually exported to Brazil. In Ecuador, Brazilian construction giant Odebrecht was expelled in 2008 after a dispute relating to the construction of the San Francisco hydroelectric plant; the case has generated tensions between the two countries ever since. A 2011 tariff on car imports from Uruguay has put a strain on relations there. The list of small outstanding grievances is long.

Collectively, these diplomatic disputes could harm Brazil's relations with its neighbors and cause Brazil to lose some of its insider advantage, says Glickhouse. "When push comes to shove, once these projects get off the ground, then the issues are the same."

Additionally, countries across the region will be watching how Brazil handles domestic development disputes. In February 2010 the Brazilian government approved the controversial Belo Monte dam in Para State, in northeastern Brazil. The proposed project has generated international attention because of its potential destruction and forced displacement of local communities and negative impact on biodiversity. Nevertheless, the government plans to proceed with the construction of the dam, which will external pagealmost certainlycall_made incite future protests that could make sour relations between Brazil and its neighbors.

Friends with All

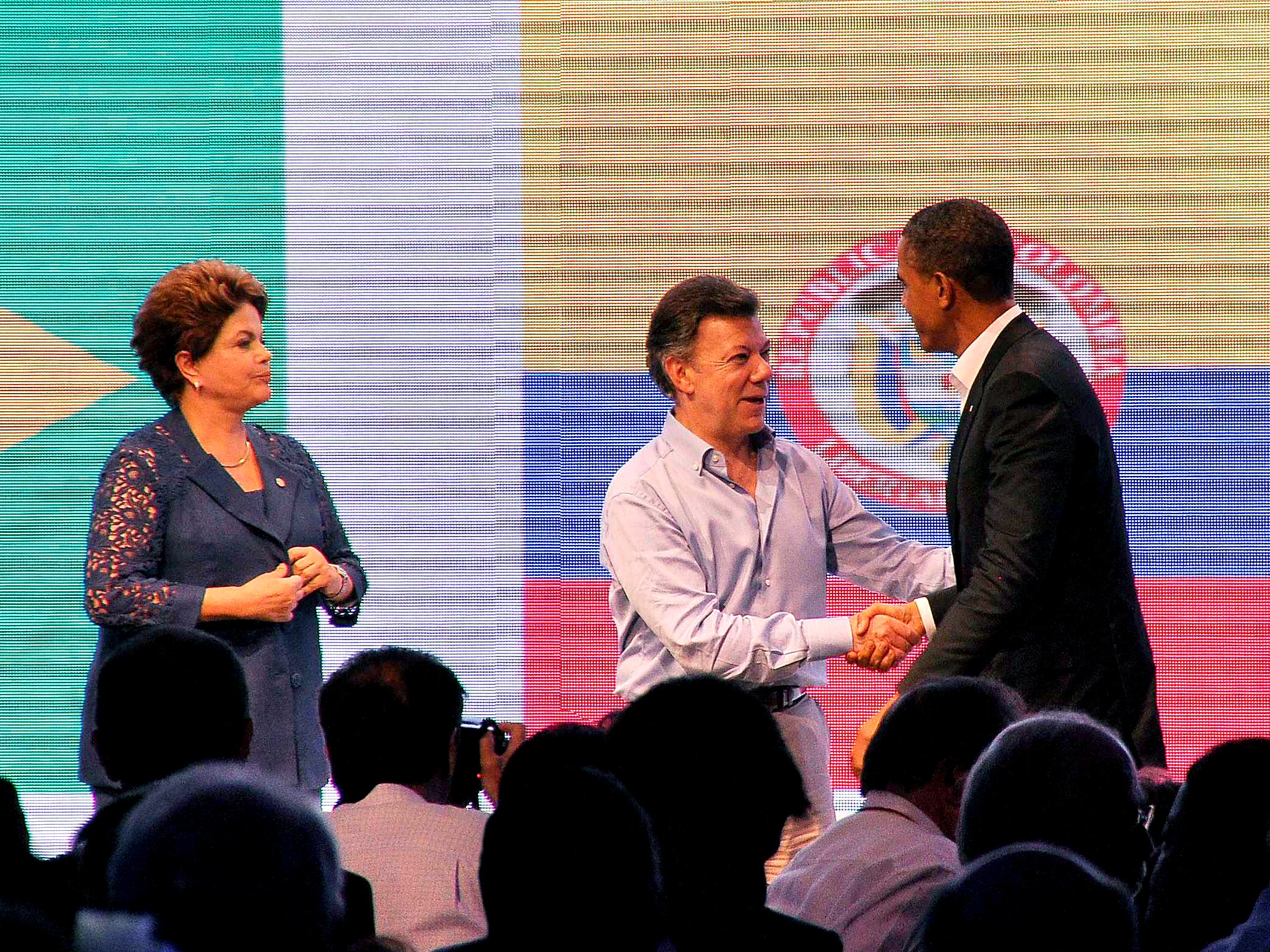

Yet in spite of these risks, Brazilian development and influence in South America continues to grow. Instead, the biggest risk to Brazilian influence may be one of neglect, as Brazil clearly has ambitions that extend beyond the region. "Brazil does not want to just be seen as the leader of Latin America, but also a global leader," adds Glickhouse. A 29th March meeting with other BRICS countries in New Delhi reinforced this notion. Brazilian President Dilma Rousseff called for the external page'reform of international organizations'call_madesuch as the United Nations Security Council as well as the creation of new global organizations that take into account Brazil's (and its fellow BRICS members') influence.

Global influence was a key tenet of the former president Luiz Inacio Lula da Silva [2003-2010], who spent his presidency projecting Brazilian soft power abroad. Lula did this via a external page'friends with all'call_made policy that, with the exception of a failed attempt to broker a uranium deal with Iran in May 2010, was vastly successful. Brazil maintains strong political capital under current Rousseff, who has focused the first 15 months of her presidency mostly on domestic issues such as corruption, infrastructure, and currency policy to make sure Brazilian exports remain competitive. The country is also preparing for the Olympics in 2016 and the World Cup in 2014.

Yet even though Brazil may not focus exclusively on South America, this does not preclude it from becoming a model for development. To be sure, each country in South America is unique, and Brazil has advantages that neighboring countries do not share, meaning that what works for Brazil will not necessarily work for other South American countries. But success is contagious, and the more that Brazil assumes a global leadership role, the more likely the halo effect from this progress will spread throughout the rest of South America.