The Arms Trade by Numbers

3 Sep 2012

The sale of small arms and conventional weapons was once regarded, at least in the minds of power-balancers, as a necessary way to maintain a stable and secure international system. Over time, however, an increasingly vocal group of critics have concluded that this multi-billion dollar industry is more a source of insecurity than not. In order to better understand why this reversal has occurred, we begin our investigation of the global arms trade this week by looking at some of the industry’s most basic features.

North to South

[Resource Embedded:151838]

As the above map illustrates, the world’s leading arms exporters are the United States and Russia. These two countries account for almost 60% of all conventional arms exports in the world, with Western Europe representing a third major trading bloc. (France, Germany and the United Kingdom account for the bulk of arms exports from this region.) And yet, although these five countries have been the world’s top five suppliers of arms for decades, SIPRI’s map also shows that parts of Asia, the Middle East and South America are developing arms industries that may eventually challenge the dominance of the traditional Big Five exporters.

Regardless of where the arms come from, either now or in the future, external pageSIPRI’s Paul Holtom reminds uscall_made that Southwest and East Asia are their major destinations. Between 2007 and 2011, for example, some of the largest importers of arms included China, India, Pakistan and South Korea. The motives of these importers, at least in many analysts’ eyes, are not only to buttress up their arsenals, but also to pursue technology transfer through the front and backdoors – i.e., to acquire the technologies they need either to develop self-sufficient defense industries of their own or to become arms exporters in their own right. In pursuing this strategy, for example, both India and China have expanded their military-industrial base, although New Delhi is still heavily “transfer-dependent.” Beijing, in turn, has not only become more self-reliant, it has also become a leading arms exporter to sub-Saharan Africa.

Arms transfers to developing and energy-exporting nations – more boom than bust

The behavior of the top arms importers illustrates that although the global economic system continues to feel the after effects of the post-2007 financial crisis, the available SIPRI data tells a different story – i.e., there has been an increase in the volume of arms sales over the past few years. That may appear to be a contradiction, given that defense expenditures are indeed driven to a large extent by prevailing economic conditions, but we also need to remember two things.

First, orders for conventional weapons are often placed well in advance of delivery dates, which creates a significant time lag between weapons purchases and government shifts towards fiscal austerity.

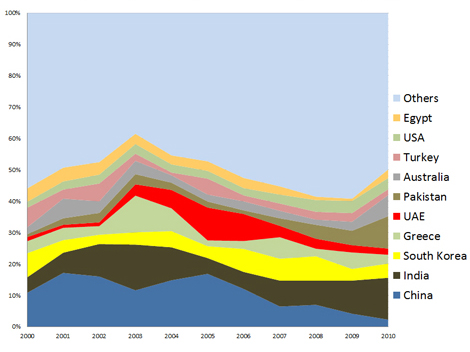

Second, the general negative impact of government austerity on global arms sales may have also been thwarted by greater defense spending, specifically by those countries that were less affected by the global economic downturn than others. In this respect, the SIPRI analysis shows that the overwhelming majority of global arms exports in recent history has been to developing countries that have fared better throughout the global recession than their counterparts in the developed world. In 2011, for example, India imported almost 12% of all arms traded globally. Similarly, states that have benefited from windfalls from oil and natural gas exports external pagehave become major recipientscall_made of conventional weapons too.

[Resource Embedded:152018]

Major distribution routes

Finally, we come to distribution routes, where the trade in small arms (which by some estimates causes up to 90% of all civilian casualties in war) is a particularly interesting case. As is perhaps to be expected, the major distribution routes of these types of weapons can be traced to the leading manufacturing countries in broader Europe and North America, as partially illustrated by the following slideshow which visualizes the destination of small arms exports from the United States between 1992 and 2010. What the presentation additionally demonstrates, both explicitly and implicitly, is the following.

First, while the United States has traditionally exported the majority of its small arms to its ‘Western’ partners, there remains a robust demand for American products in South America and parts of Asia.

Second, since the slideshow focuses only on legal, above-board small arms transfers from the United States, it inevitably tells an incomplete story. Many small arms currently in global circulation were first distributed during the Cold War, where both the United States and the Soviet Union vied for geopolitical influence among satellite states. This problem was then compounded by the collapse of the Soviet Union, which saw the rise of a new breed of unscrupulous arms dealer, who was more than willing to distribute weapons in hidden and questionable ways to some of the most conflict-ridden parts of the world.

Third, we have the problem of new actors such as China increasingly challenging the arms sales dominance of the Big Five, but doing so in “hidden hand” ways that worry analysts at SIPRI and elsewhere. (Because the latter two problems have grown as they have, we will look at them in greater detail during this week.)

Finally, to compare exports from other major arms producers, visit external pageGoogle Ideascall_made’ external pageinteractive small arms and ammunition trade visualizationcall_made, which uses data from our partners at the Peace Research Institute Oslo (PRIO).

[Resource Embedded:152116]