Arms Procurement (II): Project Dynamics

23 Nov 2015

By Michael Haas, Martin Zapfe for Center for Security Studies (CSS)

This article was originally published as CSS Analyses in Security Policy, No. 182, November 2015, by the CSS.

Future European armaments projects will continue to be marked by high costs and decreasing unit numbers. While it is possible that new approaches in procurement will alleviate that situation, success is uncertain. This will also impact the next major project of the European armaments industry – the development of unmanned combat aircraft.

The requirements for successful procurement and maintenance of military capabilities have become vastly more demanding in recent decades. With the introduction of jet engines and guided missiles as well as the development of electronic sensor arrays, and command and control systems from the 1940s onwards, arms procurement became a highly challenging task. From the 1970s onwards, this process not only continued, but further accelerated with advances wrought by the IT revolution in military affairs, so that a dwindling number of capable states found itself confronted with increasingly daunting hurdles in implementing a shrinking number of ever more complex programs. Even erstwhile military heavyweights like the Soviet Union were unable to keep pace with this development. The “defense economic problem” (see CSS Analysis 181) affects all countries that wish to procure advanced weapons systems.

Nevertheless, the European states have been feeding off their comparative advantages in economic innovation and their greater bureaucratic flexibility, which allowed even small states like non-aligned Sweden to produce state-of-the-art weapons systems such as the multirole JAS 39 “Gripen” fighter jet until well into the 1990s. Nonetheless, in Europe, too, the ability of national defense industries to conduct such procurement projects on their own is rapidly diminishing.

With the current large-scale programs nearing the end of the delivery phase, defense planning in Europe will once more face an array of vexing choices. Regardless of whether or not European defense budgets will see moderate increases, the states will not be able to buy their way out of the defense economic problem. The European states will therefore have to decide which capabilities they will still be able and willing to purchase, and determine the political and industrial bases for doing so as well as the (multinational) procurement strategies to be relied on in bringing these projects to fruition.

Autonomy vs. Capability

Since the beginnings of the high-tech era in military affairs from the 1970s onwards, European states have repeatedly been forced to make far-reaching strategic choices regarding the procurement of high-value armaments. According to their security policy, budgets, and societal preferences, Europe’s medium-sized powers as well as small states like Switzerland have had to mark out the best possible position for themselves in terms of strategic dependence versus autonomy, and find acceptable tradeoffs in military capability. This positioning continues to determine weapons procurement and industrial policy today.

Every state is forced to make compromises: Either sovereign military capability must be given up in favor of dependency on allies and foreign suppliers, or the states must accept high costs, as France does, and subsidize their own defense industries directly or indirectly, largely in the face of economic rationality. Nevertheless, until the end of the Cold War, Europe managed to build and sustain military instruments of high quality and political relevance.

Today, seven European states can still boast large and productive defense industry bases. Among them are the countries that signed the “Letter of Intent” in 2000 outlining closer cooperation in industrial policy – France, the UK, Sweden, Spain, Italy, and Germany – as well as Poland. Within this group, France and the UK as well as, to some extent, Poland have decided to pursue a certain degree of strategic autonomy in arms procurement, as a result of both political and economic considerations. The UK participates in European armaments cooperation while at the same time closely aligning itself with the US. Meanwhile, France continues to tread the idiosyncratic and expensive path of sustaining a broad range of military capabilities with the least possible reliance on external actors.

A Structural Problem

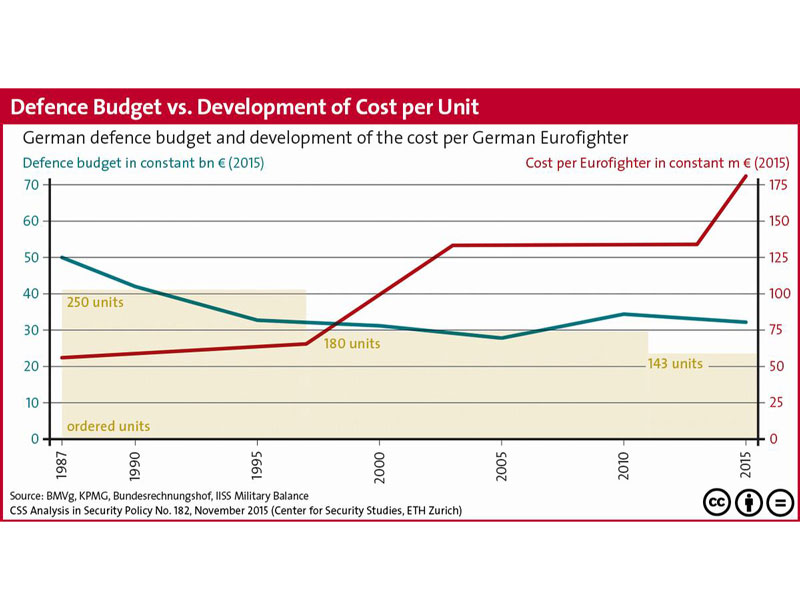

However, the concept of a broad national defense industrial base has been losing ground for two decades due to the convergence of shrinking defense budgets and sharply increasing procurement costs for state-of-the-art military capabilities. The resulting trend towards a drastic reduction of lot sizes or even the termination of important major programs has affected even the US, with its considerably higher defense spending.

For instance, the US armed forces purchased only 21 B-2 stealth bombers instead of the planned 132, and 187 F-22 “Raptor” air superiority fighters rather than the 750 units originally envisaged. Important programs such as the “Crusader” artillery system (more than 800 planned) and the RAH-66 “Comanche” reconnaissance helicopter (up to 1’200 planned) were canceled altogether. Notably, even the US ground forces essentially still rely on five main weapons systems that were introduced in the 1980s. All of the procurement programs initiated since then have been afflicted by massive cost overruns, reduced buys, and quality concerns, as has often been the case in Europe.

In contrast to the US experience, one could argue that the frequently-criticized ratio between the projected Eurofighter buy (765 aircraft) and units actually purchased, or still to be purchased, by the four partner nations (472 aircraft) looks fairly positive by comparison. In this metric, even the A400M “Atlas” military transport aircraft, beset by technical problems as it is, comes off better than the program’s bad public reputation would suggest, with the contracting states currently still having 144 (out of the original 180) aircraft on order for their armed forces.

Common Challenges

Currently, the most important multinational European procurement programs are being delivered or already in service. This applies primarily to the Eurofighter “Typhoon”, the A400M, the “Tiger” attack helicopter, and the NH90 transport helicopter. These systems can reasonably be expected to become reliable elements of European air power after some years of operational use; nevertheless, they are viewed among the general public as being emblematic of the complex coordination processes, beset by political micromanagement, and of limited military value. While this view is not entirely accurate, it explains why the actors involved will seek to clearly demarcate any follow-up projects from them. In particular, two elements of long-standing procurement strategies will increasingly diminish in importance: multinational development of specifications and multinational project management with retention of national procurement routines.

Major procurement projects are always the results of complex negotiations. Military requirements, considerations of political expediency, and economic motives stand side by side, with varying degrees of legitimacy. The main reasons for the great complexity (and frequently, the failure) of multinational programs are the difficulty of defining common requirements, the political desire for symbolic cooperation (or autonomy, as the case may be), and the imperative to protect national industries, jobs, and know-how. The earlier these varying motives come together, and the more states participate in the process, the more complex and potentially problematic the project and the product will likely turn out to be.

After the initial coordination efforts, the subsequent management of such procurement programs is also a highly complex task. Traditionally, bilateral agencies (as was originally the case with the Eurocopter “Tiger”), management agencies under NATO’s aegis (such as the NATO Eurofighter and Tornado Management Agency, or NETMA), or autonomous multinational agencies handling several parallel projects, such as the Organisation for Joint Armament Cooperation (OCCAR, which is responsible for the A400M, among other projects) have attempted to provide such services. So far, all three forms of management have delivered mixed results at best. Only a few projects have steered clear of the dangers that come with a constant flow of new and further-reaching requirements by individual participating states, problems in quality control, or regulatory objections over certification. While these problems have been recurring for decades, especially in drawn-out procurement processes that significantly affect the overall portfolio of a state’s armed forces (for instance, in the case of a multirole fighter, the process may take about 15 years and absorb a percentage of the procurement budget in the double digits), they are apparently nearly impossible to eliminate. A chain reaction of further delays and cost overruns has all too often been the consequence. So far, no satisfactory form of project management has been found in what is an extremely politicized environment. It is highly unlikely that future procurement programs of comparable complexity, e.g., for next-generation combat aircraft, air defense systems, or warships, will be spared all of these troubles. It is therefore only reasonable to expect further deep reductions in planned, and ultimately also purchased, units as well as numerous complications relating to project management.

Figure: Defence budget vs. development of cost per unit (click to enlarge).

Novel Procurement Strategies?

In the planning and management of armaments programs, the trend appears to be shifting away from ubiquitous multinationality and established institutions. This development can be briefly subsumed under the headings of “irregular approaches to procurement” and “lead nations”.

First of all, at the national level, states increasingly rely on procurement paths that are distinct from the designated processes. Thus, during its wars in Iraq and Afghanistan, the US developed new approaches for introducing critical operational capabilities (such as mine-resistant, ambush-protected vehicles) quickly and efficiently by bypassing the established procurement bureaucracy. This can also be observed in other countries; for instance, in Germany, the instrument of “mission-critical immediate requirements” (einsatzbedingter Sofortbedarf) was created. In the meantime, comparable approaches are also employed in the implementation of high-tech weapons programs. For instance, the US Air Force’s top-secret strategic bomber program, a follow-up to the B-2, is being orchestrated by a “Rapid Capabilities Office” that bypasses the usual procurement process. The German Defense Ministry, distrusting the established bureaucratic processes and wishing to improve project management, has also decided to implement major projects such as the procurement of its next multi-mission warship and air defense system, as well as the MALE UAV reconnaissance drone outside of established structures.

Secondly, at the multinational level, lead nations are increasingly claiming unilateral or bilateral project leadership in order to keep friction manageable. The best-known example is the multilateral cooperation in developing the multirole F-35 “Lightning II” fighter. While this product is also plagued by very considerable development problems, the latter are due not least to the attempt to engineer an aircraft that will serve three branches of the US military simultaneously. Multinational cooperation on this project, on the other hand, can be seen as a largely positive model: The US develops the specifications for the F-35 largely on its own (in close cooperation with the UK and other important allies) and determines all the basic parameters of the project. The other partner states contribute funds to cover development costs, which gives them a certain degree of co-determination and industrial involvement. However, the US retains the role of principal actor.

This model may be gaining popularity. Cooperation between France and the UK in the development of an “Future Combat Air System” (FCAS) appears to be designed to retain project leadership and to secure technical know-how in the quasi-sovereign Dassault and BAE corporations, while leaving the door open for European partners to buy into this critical future capability at a later stage. What is more important here than economic efficiency is the desire to retain political control over a sensitive project and to make military capabilities available relatively quickly. Nevertheless, it appears that the development of a European combat drone as well as potential follow-up projects will take place under the firm guidance of one (or a very small number of) lead nations, while symbolic cooperation will take a back seat – possibly at the expense of established planning and management structures such as the European Defence Agency (EDA) and OCCAR.

“The Next Big Thing”

In addition to strictly procurement-related matters, the coming years are also expected to bring crucial decisions in matters of substance if the European countries wish to retain the capacity for producing cutting-edge military equipment of their own in the future.

The major arms procurement programs of the past years are now expiring. This obviously raises the question of what the next comprehensive European weapons program will be. Notwithstanding the political and ethical concerns in many European countries, the development of unmanned combat aircraft is currently the most likely prospect.

Nearly all European states have now decided in favor of unarmed surveillance drones, and the procurement of such systems will continue in the coming years. The considerably more complex debate over the use of autonomous weapons systems, i.e., platforms acting without permanent and immediate human control, mainly for air and naval forces, is only beginning and will most likely continue for many years to come, due to the fundamental political and ethical questions involved. Already today, however, the deployment of semi-autonomous systems, in which weapons release must be directly approved by a human controller, is a very real prospect.

European industry currently has the lead in the development of two demonstrator projects for such capabilities. The state of the art is embodied in both BAE’s “Taranis” drone and the “nEUROn” demonstrator, the latter being developed by a consortium led by Dassault (and with participation of Switzerland’s RUAG). Based on these preliminary programs, a FCAS prototype is to be developed – under joint French-British leadership, as mentioned – that might reach maturity by the 2030s.

The feasibility of such an unmanned, sixth-generation combat aircraft is currently still a subject of intense research. However, if it should be brought to fruition, a number of important questions would arise, relating inter alia to delicate matters of political-military stability, operational control, and cybersecurity. The format of multilateral cooperation and the sequencing of the production process require intensive discussion; the most obvious solution is the concept of a staggered and unequal international division of labor under the leadership of one or both lead nations, as seen in the F-35 program. Precisely because of the resistance in many European states, the nations that are willing to cooperate are likely to forge ahead in order to maintain European expertise and industrial capabilities. This would permit politically reticent states to join the project at a later date or at least to purchase a European armed drone off-the-shelf from a European partner – though without any significant input or extensive involvement of their own national defense industries.

Uncertain Prospects

Changes in the security environment in recent years have led to the recognition that the possibility of conventional conflicts of considerable intensity on the European continent can no longer be excluded. At the same time, the extent of future conventional and sub-conventional (“hybrid”) threats and their implications for the national arms procurement policies remain difficult to predict at this point in time. Such threats would be added to the myriad instabilities along the southern and southeastern periphery of the European continent, with flashpoints in Syria, Iraq, and Libya. In view of a complex constellation of challenges and interests, there is currently no real and sustainable consensus within or between the EU or NATO on the fundamental alignment of European defense.

At the same time, far-reaching and politically sensitive issues will have to be tackled in the coming years, especially with respect to further automation of warfare and the introduction of weapons systems that incorporate at least some elements of autonomy. Overall, from a project-centric perspective, the major trends in European defense planning for the next 10 to 15 years have already taken shape to some extent, but far-reaching structural uncertainties remain.