An Energy World Order in Flux

25 Mar 2016

By Severin Fischer for Center for Security Studies (CSS)

This chapter of Strategic Trends 2016 can also be accessed here.

Volatile commodity prices, new technologies, changing market patterns and a growing flexibility in energy relations: The energy world has experienced a fundamental transition over the last decade. Many traditional views and conventional wisdom about the role of energy in foreign and security policies can today be put into question. The political influence of suppliers is set to be diluted. Hand in hand with this goes a temporary shift of power in favor of energy consumers. Instability in producer states will become the main energy-related security feature.

While conflicts in Northern Africa and the Middle East, the growing number of refugees and the war in Ukraine dominated media headlines in 2015, energy recently seemed to be a rather stabilizing factor in the security debate. In the present situation of shrinking commodity prices, traditional energy-related security questions – how to deal with the scarcity of resources or how to handle the political influence of oil and gas producing states – have lost significance. This, however, might turn out to be misguided. The ongoing changes in the energy world deserve close analysis from the security policy angle since they tend to create new imbalances and challenges in the future. Russia’s growing hostility towards its neighborhood, the ongoing conflict between Saudi Arabia and Iran, civil war in Libya – none of these developments could be explained without the energy factor.

For several security-related reasons, recent developments in the energy world deserve close attention. First and foremost because oil and gas prices influence the stability of regimes in resource-rich and crisis-torn regions. Energy plays a significant role for regional security in this context. Second, market developments have an impact on the energy world order, understood as the formal or informal set of rules that structure the relationships between suppliers and consumers; individually and as groups of states. Third, developments in the energy world matter because conventional wisdoms about the future of energy supply need to be put under scrutiny, be it peak oil theories, the controversy between the Organization of Petroleum Exporting Countries (OPEC) and the West, or the long-term nature of mutual gas supply dependencies.

The first part of this chapter focuses on the underlying market fundamentals as well as political reactions to low oil prices such as OPEC’s part in stabilizing markets. The crucial role of Saudi Arabia deserves special attention here. A second part assesses the role of gas markets. Here, the changing nature of long-term gas relations between states, the rise of liquefied natural gas (LNG) trade and the globalization of gas markets will be analyzed. The need to reconsider the relationship between Russia and the EU is a relevant topic in this context. The final part of this chapter concentrates on the foreign and security policy implications of these changes in energy markets and supplier-consumer relations, pointing to four crucial security challenges for the coming years.

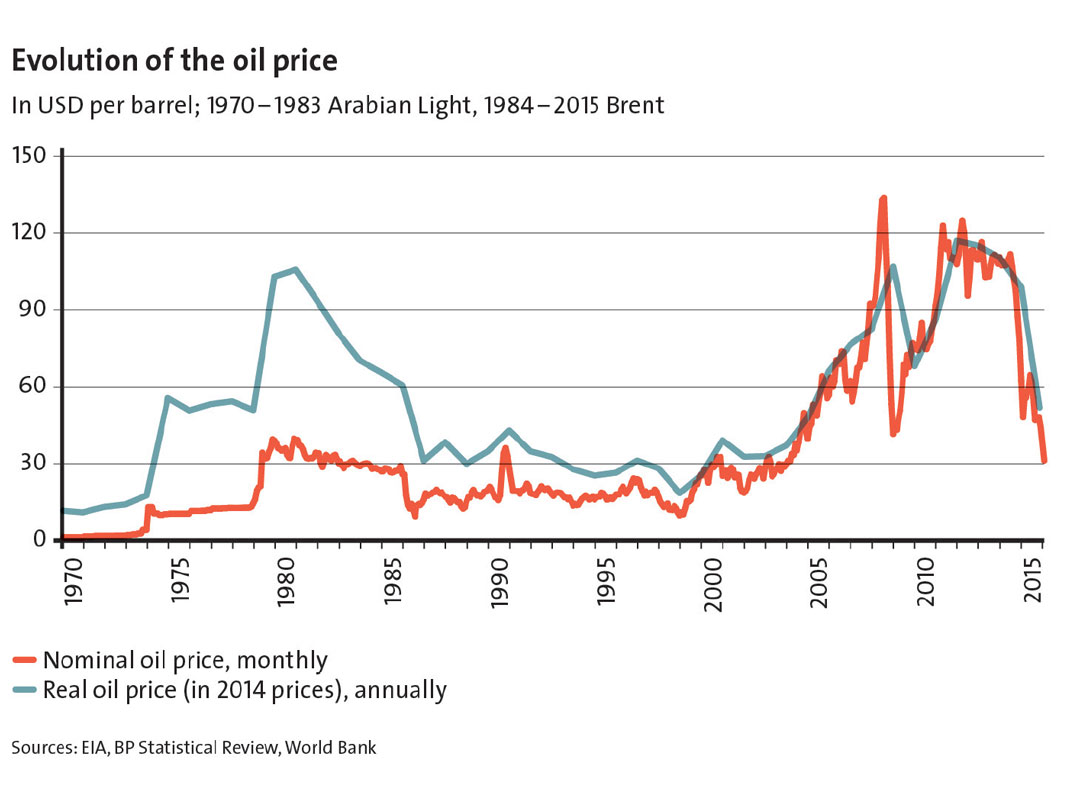

A world of cheap oil

In January 2016, spot market prices for a barrel of Brent oil hit a record low of less than USD 30, as low as it had last been thirteen years ago. This development looks even more impressive when considering inflation-adjusted real prices, which hint at a comparable level as decades ago. Far more important than touching these symbolic thresholds, however, is the speed of the recent oil price decline itself. The price fall started only in mid-2014 at around USD 115 per barrel and had not stopped until recently. Today, nearly all relevant market indicators suggest that this massive devaluation of crude oil is set to last for at least another year or two, with only slight recovery afterwards. Even a comeback to levels of USD 60 or 70 per barrel would still mean a fundamental deviation from most long-term market outlooks.

(Click to enlarge)

Before assessing the effects of these price developments, it is necessary to analyze what is driving this unexpected turnaround in the oil markets. What happened to the strategic outlooks suggesting scarcity rather than an oil glut? There is not one single cause to explain the phenomenon. It rather has the character of a set of self-enforcing developments, leading to a snowball effect. The most relevant factors are to be found on the supply side of the oil market. The massive increase of production in the United States over the course of the last five years has added significantly to an increase in global oil production by 10 percent. Most of this additional production capacity is in the hands of comparatively small and medium-sized US companies, using fracking technologies to access shale reserves – a veritable army of flexible producers with short investment cycles. In addition, new large-scale exploration on a global scale (e.g. Brazilian offshore drilling) and additional production by established oil producing countries (e.g. Russia) as a response to falling prices have completed the picture. The recovery of war-torn states like Iraq adds to the positive outlook. While Syria’s production capacity is of minor relevance, other critical suppliers like Nigeria increased their production levels again. Finally, the expected comeback of Iranian oil exports after the lifting of sanctions completes a bloomy picture on the supply side.

The second set of factors that has driven oil prices down can be found in the low-growth expectations of consumers. Mainly China’s appetite for oil seems to be significantly smaller than expected. Although overall global oil consumption keeps rising and reached a maximum of over 95 million barrels a day in the second half of 2015, the rates of growth are set to decrease. After a period of comparatively high oil prices during the economic recession, companies and states started to consider lower consumption and alternative fuels as an economically sensible option – with significant impact on the demand side.

Both developments merge into a picture of global oil oversupply at an average of around 1.5 to 2 million barrels per day. This situation has been a market structuring feature since mid-2015. A good indicator for a continuation of a phase of low prices is the massive increase in oil stocks around the world, which reached an all-time high of 3 billion barrels in December 2015. This also underlines the assumption that the present oil price developments are reflecting real supply-demand imbalances rather than a speculative bubble. Even the oil producers’ World Oil Outlook expects an optimistic rise to only USD 80 per barrel by 2020.

Obviously, any discussion about the future oil price is unreliable, even more so when looking into the distant future. It is remarkable, however, that even the recent political crisis between Saudi Arabia and Iran has left oil prices largely unimpressed. Most indicators today point in the direction of a low-price scenario until the mid-2020s. A military conflict in one of the big producer states may be the only realistic scenario to cause a new price hike in the near future. For political analysts, the most interesting question behind this new low oil price scenario is the relative gain and loss of power as well as its effect on the energy world order. This also requires a distinction between economic and political factors.

Economically, the energy-intensive and fuel-importing economies in Asia and Europe benefit most from the low-price environment, at least in the short term. After years of crisis in Europe and in times of lower growth rates in China, the improvement of trade balances is a stabilizing economic factor. It also helps state budgets through lower fuel subsidies, which has great relevance in emerging economies such as India. This, however, is not a zero-sum game, since low oil prices could also initiate a global recession with unknown consequences. So far, Europe and the emerging economies in Asia, as well as the United States, are among the winners of the low-price era. In the US, a growing oil and gas industry has increased tax revenues and created jobs. Reduced imports and the political decision to allow exports of oil and gas have also improved the trade balance sheet. Despite these positive developments, it is not clear for how long the US shale oil industry can sustain the pressure of low oil prices. They could soon fall victim to price competition, partially caused by their own massive increase of production in recent years. While the US oil drillers survived 2015 price levels with improvements in efficiency, 2016 will most likely see a market consolidation. Although the survival skills of the US shale industry might be exhausted soon, the new political self-perception of the US as a largely independent energy superpower prevails, and has implications for US foreign and security policy. Military interventions in regional conflicts to guarantee access to energy sources have lost significance in the national discourse.

Current oil price developments also create economic losers. Many international oil companies (IOCs) with high-price production assets, such as those in the Arctic or in the deep sea, are facing economic difficulties, and need to cut back on new projects. In total, IOCs have cancelled at least USD 200 billion worth of investments in 2015 alone. This could mean that the influence of Western IOCs on the oil production of the future is shrinking. Their reluctance to invest also affects potential future suppliers with relatively high production costs negatively; Brazil being a prime example.

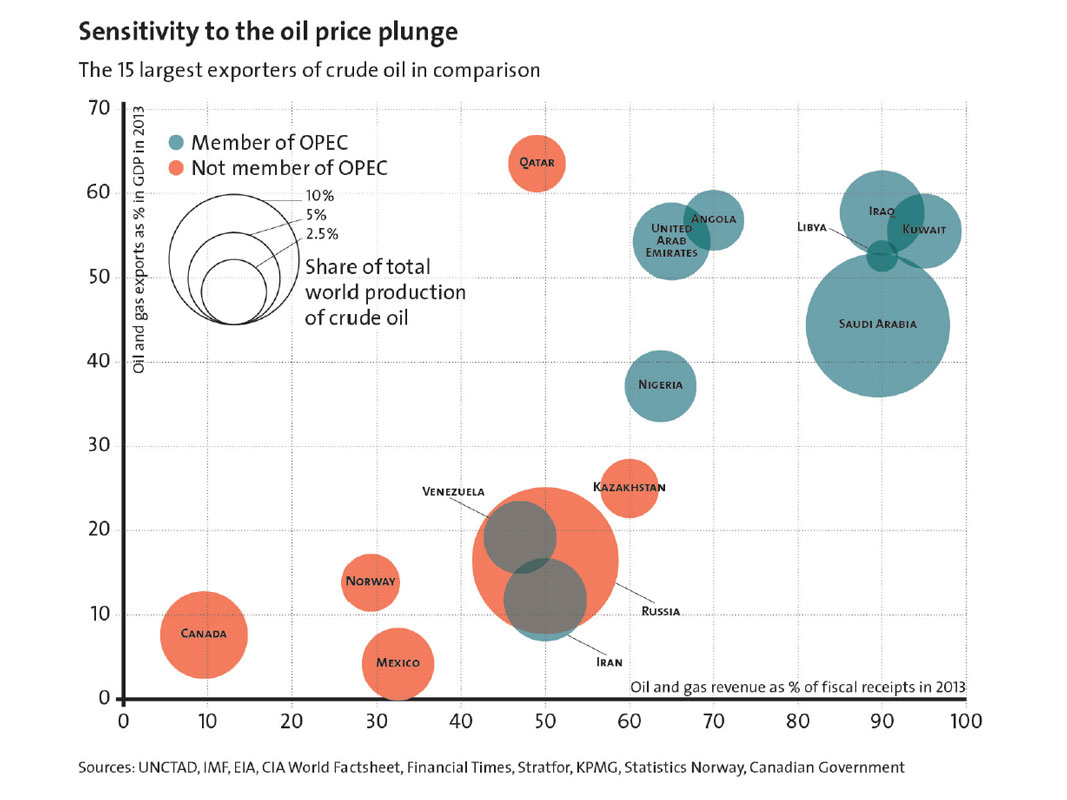

In the short term, however, states with high shares of oil exports in their GDP are moving into difficult waters; such as countries in the Persian Gulf, and/or producers with high domestic budgetary spending in the form of subsidies, such as Venezuela. Monetary policy also plays a role: Economies with free-floating currencies can temporarily cope better with the present situation than those closely pegged to the US dollar, although this offers only short-term relief. The currency devaluation in Russia presents one of the examples where wages and public debt can be paid with a cheaper ruble. Effects on the state budget look less harmful if currency inflation is used. For this reason did Kazakhstan and Azerbaijan recently free their currency from the dollar-peg. However, the consequence is growing costs for imports and increased the likelihood of social unrest. Finally, countries with a sovereign wealth fund from oil revenues and large foreign currency reserves can sustain themselves longer in the present situation than those who need to borrow money abroad or from their citizens. In that respect, Norway, Qatar or Saudi Arabia have a longer breath than most others. The Saudi monarchy was able to cover its USD 90 billion budget deficit in 2015 through its state fund. However, like currency devaluation, this can only be a temporary measure. Exemplary for this is Saudi Arabia’s announcement to cut subsidies, to introduce taxes and to sell shares of its large national oil company Saudi Aramco.

Beyond the pure economic balance sheets, naturally, there is also a political dimension to the oil market developments. In the past, the ‘oil weapon’ – the use of production quotas as an instrument of political coercion – was a common narrative to describe energy security challenges caused by OPEC. The political role of OPEC as a producer cartel and its ability to act as such have changed over the past decade. Two developments are important in this context. First, OPEC’s share of global production has declined significantly. While a number of new producers has entered the market lately, the rise of US oil production had the biggest impact. Today, OPEC controls only roughly a third of global production, down from around half in the 1970s. There had been lower levels in the time between, yet those were mainly caused by artificial restrictions of production and not by capacity limitations. Today, market shares are more spread out, mostly due to recent production growth in the US and Russia. Although OPEC still controls most of the known geological reserves, this asset has only limited influence on today’s prices. Second, OPEC’s internal cohesion is eroding more and more. The gap between the ‘haves’, countries with high rates and low costs of production such as Saudi Arabia, and the ‘have-nots’, countries with low production rates and/or high production prices (basically everyone outside the Gulf region) is widening. Hence, OPEC’s ability to develop common positions is diminishing. Calls from inside and outside OPEC to cut production in order to stabilize prices at a level above USD 50 per barrel are in fact calls for Saudi Arabia to do so, being the only potential and relevant ‘swing producer’ left in the group. All other members either cannot afford such a measure or are too small to have an impact.

(Click to enlarge)

If OPEC’s destiny is in the hands of Saudi Arabia, why is the oil monarchy not acting on the present situation by lowering output to increase prices for all producers’ sake? Four reasons might explain Saudi Arabia’s reluctance to reduce production: First, Saudi Arabia sees itself as one player in a ‘game of chicken’, in which those who make the first move are set to lose. The individual motivation to cut supplies while other suppliers inside or outside of OPEC do not do the same, and benefit from this move, seems low. Past experience supports the validity of this assumption, since OPEC’s system of production control has proved inadequate. In this sense, the gains for Saudi Arabia would hardly outweigh the costs in the short run and set a misguiding signal for future measures. As the recent move towards an agreement for a production freeze with Russia shows: There is little interest in reducing production while others keep increasing their production levels.

Second, from Saudi Arabia’s point of view, the biggest new competitor in the oil market, the US shale oil industry, can only be successfully defeated by making their production unprofitable. According to many analysts, it would require another year or two until a significant number of US companies goes bankrupt. Already in 2015, the number of newly developed oil rigs in the US was in decline. However, the effect could only be a temporary one, with market consolidation and higher efficiency in drilling as a result. The flexibility and adaptability of US oil businesses is still not known. Companies could be back in the market within a relatively short period of time when prices reach a medium level again. Therefore, it looks plausible to suggest that the US shale industry has taken over the role of a market-driven swing producer, substituting for Saudi Arabia in its role as a politics driven swing producer of the past.

Third, broader geopolitical arguments can explain Saudi Arabia’s inaction. The conflict between Saudi Arabia and Iran could find a translation into the energy world. With the end of sanctions, Iran’s hopes to enter global oil markets and to find investors again are in real danger in view of today’s low oil price environment. Stopping Iran from gaining additional revenues and modernizing its ageing infrastructure could be a relevant factor in the whole range of explanations for the Saudi strategy. It also explains why Saudi Arabia will not agree on production cut without Iran committing to a similar move.

Finally, one could also argue that Saudi Arabia’s hesitation to act on the issue is due to fears concerning the potential ineffectiveness of the measure itself. The country’s main power asset of the past decades has been its control of oil supplies by opening or closing taps. Due to many different developments, mainly the emergence of new actors in oil production, this role has diminished. In a scenario in which Saudi Arabia cuts production significantly but other producers step in and prices do not change at all, the new reality of a less powerful Saudi Arabia would become obvious. Instead of testing the limits of its power, the monarchy rather rests on the traditional view that it is an oil power, without defining its range of influence in present day markets.

Recent developments in global oil markets and the looming period of cheap oil are changing basic assumptions about global energy relations and the influence of oil on politics. In a nutshell, we can see the economically more powerful and politically more independent United States starting to export crude oil and hoping for a continuation of the present situation. European and most Asian economies take a deep breath due to otherwise less optimistic economic outlooks. Crucial changes, however, can be seen with respect to the economic and political situation of oil exporting countries, mainly Saudi Arabia and Russia, which deserves a closer look in the last part of this chapter.

New routes, more flexibility: Natural gas goes global

While individual and group actors’ economic influence in global oil market developments have been a common energy security study feature over the last decades, natural gas has traditionally been viewed as a merely regional, less economic yet highly political issue. So far, long-term contracts, large-scale pipeline projects, and relations based on mutual dependency were the currency of gas politics. This has changed in the last couple of years. Marketization, technological development and new ways of transportation have had a severe impact on the economics behind the politics of natural gas. Under these new circumstances, the security debate around natural gas also requires an adjustment.

The growing use of natural gas is a phenomenon of the second half of the 20th century. Compared to oil and coal, high costs for transportation and storage had hindered the full entry into the energy system before. Natural gas started to gain ground only with the oil crises of the 1970s and 1980s, the development of North Sea oil and gas drilling as well as growing environmental concerns. Due to its low carbon intensity, natural gas is likely to become an even more important fuel on a global scale in the next decades.

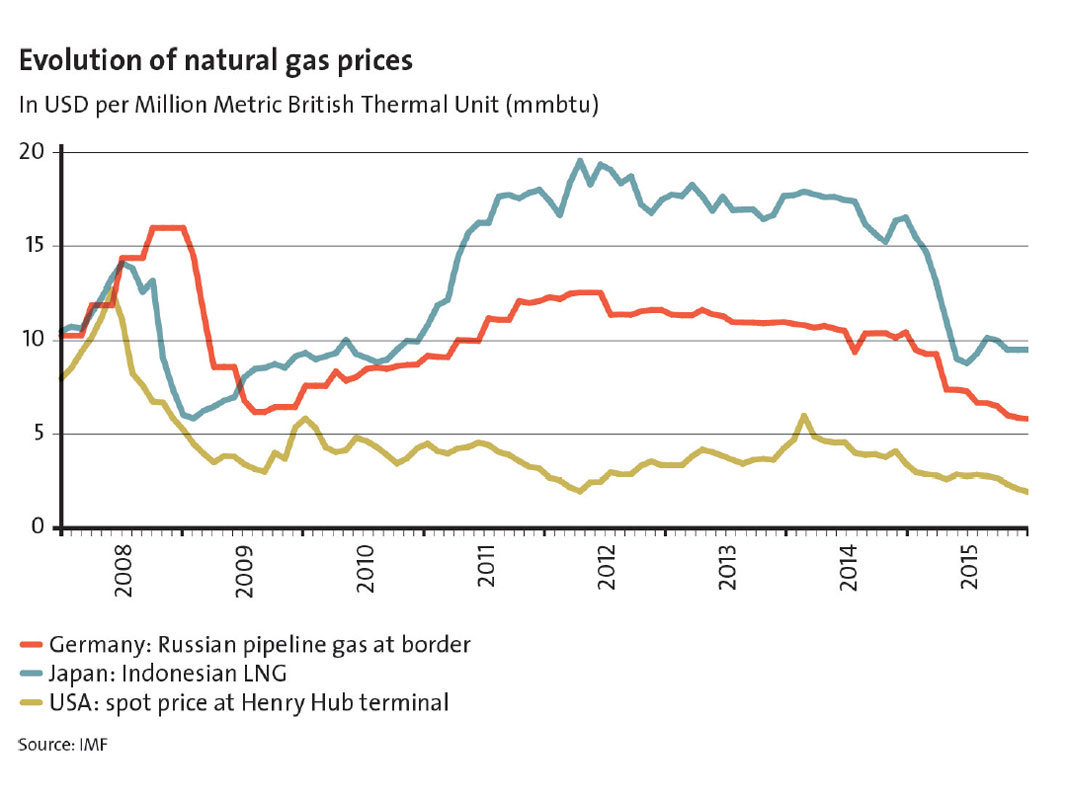

Contrary to oil, natural gas markets have been organized on regional grounds, mainly due to high inter-regional transportation costs. Three markets emerged: a Northern American one, large and mainly self-sufficient with production in the US and Canada; a European market of similar size, supplied by slowly decreasing domestic production in the EU and growing imports from Norway, Russia and Algeria; and finally, a late-coming and small but fast-growing Asian-Pacific market, with Japan and South Korea as the biggest consumers of natural gas delivered by ship. Trade in these markets was organized through long-term contracts between producers and consumers based on oil-indexed formulas, since natural gas had traditionally been a waste product of oil drilling.

(Click to enlarge)

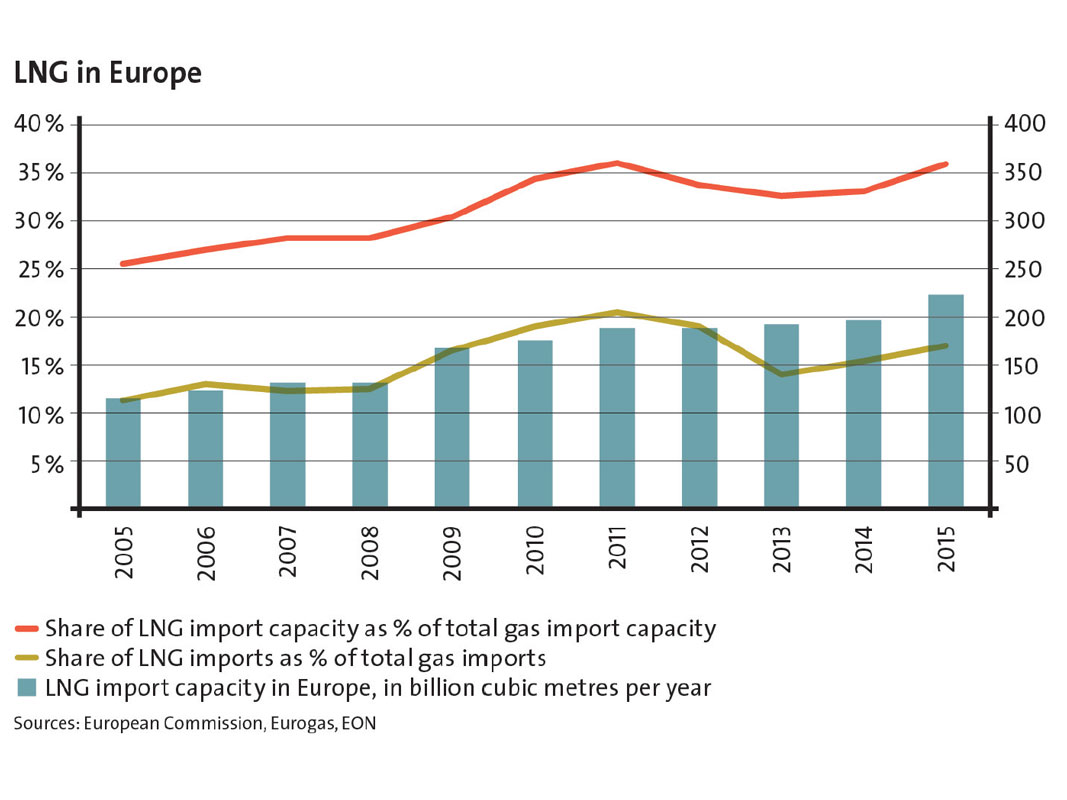

In the past decade, the landscape of natural gas markets has significantly changed, mainly due to three inter-linked developments. First, with the rise of liquefied natural gas (LNG), the mode of gas transportation by pipeline has experienced competition, causing more flexibility in trade. For many years, gas relations were based on high-cost infrastructure projects that were financed by oil-indexed long-term contracts. While Japan and other Asian countries had been relying on LNG for quite some time already, companies in the US began to develop plans and to invest in LNG import facilities in the 1990s. In Europe, LNG trade was a latecomer and only chosen by a handful of countries as a possible supply option. Companies and policy-makers in Spain and France, later in the UK and Italy, decided individually to invest in LNG import facilities. Especially for Southern European countries, this was seen as an option to get access to North African suppliers. Due to efficiency gains in the cost structure, LNG reached a level of more than 20 percent of EU imports in 2011. Today, LNG terminals cover one third of the EU’s total gas import infrastructure.

Second, the organization of markets and the mechanisms of pricing natural gas have changed over the course of the last decades. Originating in the US, the creation of gas trading hubs and a de-linking from oil prices influenced the way natural gas is traded as a commodity. In the US, the Henry hub has emerged as the reference price for gas trading. In Europe, this process was much more fragmented. Great Britain and the Netherlands started trading on hubs already in the 1990s, when the rest of Europe was still living in a world of more or less opaque long-term contracts with strong oil-price linkages. For many years, it used to be common sense for European consumers that rising oil prices were followed by rising gas prices with a short time lag. The success of trading hubs and the push by the European Commission towards liberalization have changed these market fundamentals of natural gas trade in Europe. Although with regional differences, the share of flexible hub trading has been rising constantly. Even Russia’s Gazprom started first spot market trade. High oil prices and an oversupply of gas in the European market in the years 2011 – 13 emerged as a disadvantage to those companies linked to suppliers with oil-indexed long-term contracts.

As a third development in natural gas markets, the growth in LNG trade and the liberalization of natural gas markets coincided with a technological innovation that has overrun gas markets in the past years, namely the emergence of hydraulic fracturing and horizontal drilling – or to use a more common phrase: the shale gas revolution. It took off around 2007/08 in the United States. Within a very short period of time, outlooks concerning the future development of global gas markets had to be revised fundamentally. Shale companies in the US created an oversupply in the market, imports were stopped and a natural gas glut emerged on a global scale. US LNG import facilities were transformed into liquefaction terminals for exporting gas. In the follow-up, the increasing amount of US shale gas brought a new price dynamic into a liberalized US gas market that showed clear deviations from oil price developments. Natural gas prices dropped to an all-time low, creating a significant price gap between the US and Europe as well as Asian markets.

Looking at the price developments in the different regional markets, the effects of the three innovations can be recognized. For many years, a correlation of price developments – although on different levels – in American, European and Asian-Pacific regions was a basic market condition, but around 2009 a downward trend in US prices became obvious. At the same time, European and Asian prices moved upward due to the prevailing oil price linkages. Demand in the Asian-Pacific market received an additional push upwards when the Fukushima accident in Japan led to a closure of nuclear power plants and natural gas became even more attractive, incentivizing new gas producers in Australia and Africa to enter this high-price market even faster. In the European market, however, a reduction of demand due to the economic crisis and an increase of the use of coal and renewable energies in the electricity sector led to a significant drop of the share of natural gas in the market. At the same time, flexible spot-market trading at hubs increased, mainly due to the competitive advantage compared to long-term oil-indexed contracts with Russian or Algerian suppliers. Lately, low demand and low spot market prices turned out to be a problem for the LNG business as well.

Some parameters have changed fundamentally in the European gas market over the last couple of years. Most importantly, Gazprom’s business model is under pressure. The increase of LNG imports and the emergence of spot market trading run contrary to Russia’s interest in long-term and oil-indexed pipeline contracts with selected European partners. The pure existence of alternative supplies and new pricing mechanisms has recently led to renegotiations of gas contracts. An exemplary case is the opening of an LNG terminal close to the Lithuanian town of Klaipeda, which, by its mere existence, resulted in a renegotiation of the pipeline contract with Gazprom. Similarly, the elimination of destination clauses in supply contracts weakened the Russian grip on the European market since companies started to use pipelines in different directions, as the European supplies to Ukraine currently show. Another aspect is the change of perspective on infrastructure in the European market: The fleet of underutilized LNG terminals in Europe can be seen as a sort of infrastructural insurance to keep long-term gas contracts under control. This looks especially relevant in times of low gas demand in Europe, mainly due to the economic crisis, cheap coal and growing electricity generation from renewable energies. In this context, the influence of EU member states as market players has significantly been restricted, with more power given to the EU Commission as a watch-guard for the functioning of a liberalized market. The EU’s role today is to be found mainly in enabling investments in infrastructure diversification, in reverse-flow and in interconnection capacity.

(Click to enlarge)

For gas suppliers, new market flexibility and the globalization of trade has offered opportunities for new actors to enter the scene, and put traditional gas producers under pressure to adjust their business model. Russia’s gas monopolist Gazprom is a striking case in point. For decades, the relationship between Gazprom and its partners in Europe – except for some Central and Eastern European states with geographically unfortunate locations – was based on mutual dependency and stable supply relations. Today, Gazprom’s customers are beginning to enjoy the freedom to choose their gas supply from a growing number of sources. Adding to that, the role of transit countries has turned out to be a risk factor to every gas trade relationship. In this new emerging market model, the blackmailing potential of transit countries has grown since other suppliers are ready to fill the gap in the case of supply disruptions, reducing pressure on the consumers. Finally, and most troublesome for traditional suppliers in the recent past, the European Union adopted a market model that seems to be in harsh contrast to what producers would see as preferable for their gas export: full control of the whole value chain from gas exploration over pipeline operation right through to the end consumer distribution. The planned South Stream pipeline across the Black Sea to Bulgaria was stopped by the EU Commission’s veto against Gazprom’s plans to have full control over the pipeline reaching into EU territory. As a result, Gazprom cancelled the project and turned towards investing in Turkish Stream, to access a growing Turkish market with an option to transit gas via Turkey to European consumers. But this project has also been put on hold due to growing tensions between Russia and Turkey after the downing of a Russian fighter jet violating Turkish airspace. In summary, stable and reliable long-term gas relations are under pressure from markets and politics while flexibility and short-term deals do prevail, even if they are not always the cheapest option for consumers.

This short analysis reveals the following: First, natural gas markets become more flexible and the consumer has a strong voice in defining the rules of the game. The EU Commission’s regulatory power has even pushed Gazprom to start spot market trade and to cancel destination clauses in gas contracts. Second, due to the risky investment in an increasingly volatile market environment, suppliers are trying to avoid additional risk factors, such as transit countries. Gazprom’s main aim seems to be to access the European market without relying on goodwill or risking blackmailing by Ukrainian or Turkish transit pipeline operators. As a result, it plans to build the ‘Nordstream 2’ pipeline, which would enlarge the existing direct connection between Russia and the European market. At the same time, Russian companies are also investing in LNG in order to benefit from the new market flexibility. This follows a step Norway’s Statoil had already taken a couple of years ago.

The changes in gas relations as well as the globalization of gas markets have been a fascinating process over the last couple of years and will affect the role of natural gas in global energy supply in the future. For the next approximately ten years, a couple of assumptions can be made. First, although the LNG market will grow on a global scale, oil-indexed long-term contracts are still able to compete under the current oil price developments.

Especially in Europe, the growth of LNG will be limited due to cheaper pipeline gas coming from Norway and Russia. The mere existence of LNG terminals, however, guarantees a higher degree of supply security. Second, most of the new pipeline projects will connect producer and consumer countries directly. The existing transit business (through Ukraine, Belarus) will most likely not be extended further, and future projects with transit (mainly through Turkey) will be realized only on a limited scale. Third, compared to other regions in the world, Europe’s domestic resources are depleting, and a shale gas revolution is not taking place. Only the Mediterranean, the Black Sea and some smaller projects offer real prospects for exploration. If energy efficiency and other energy sources are not compensating for the decline in domestic production, Europe will need to import more gas in relative and maybe even in absolute terms. Hence, the European situation is completely different from other regions where demand is set to increase dramatically, where new exploration is taking place and shale gas could play a significant role. In the future, demand in other parts of the world may grow, and supply of natural gas will be less abundant. The challenge for Europe is therefore to make use of today’s comfortable situation to prepare for a more uncertain future.

The new energy world and emerging security challenges

Changing patterns in oil and natural gas markets do not only influence prices and market dynamics. They also have implications for other policy areas, especially questions around security beyond guaranteeing stable energy supplies. For many years, the dichotomy of OPEC producers versus the Western world or the trust-building nature of mutual dependencies between European states and Russia were considered common sense in geopolitical considerations. The analyses of these constellations are in need of a revision. The energy world order is in flux, which creates new challenges and requires new answers. New dependencies and the emergence of new actors are the central features in this context. Four strategic trends in the energy world are set to influence security policies in the future:

Not access to energy sources but access to markets is crucial

The security dimension of access to energy sources as a common concern has been officially recognized since the first oil crisis in the 1970s. Access to energy also used to play a vital role in military conflicts. The US strategy to guarantee stability in the Middle East was based, among other aspects, on an overall strategy to secure a stable flow of oil from east to west, namely from the Gulf to the US. European countries have silently benefited from the role of the US as a caretaker of European energy security. In a world of temporary abundance of resources, military engagement to secure access to supplies has lost significance, especially for the biggest supplier of liquid fuels in the world, the US. This does not imply, however, that stabilization in the Middle East lost its geopolitical meaning. Energy’s decisive role is just fading.

New challenges are now emerging for supplier countries, especially among those states that would like to access the market and are hindered for geographical and/or economic reasons. The most prominent example here is Iran with its vast resources of oil and gas. Due to current price developments, attracting investors and starting its comeback as a major producer has turned out to be difficult. Saudi Arabia’s low-price strategy is seen as the main cause, and a further escalation of the conflict is possible. Others, such as Azerbaijan, Turkmenistan or the Kurdish region in Iraq might see difficulties entering markets in the future due to their geographical location. Dependencies of those countries on other states (Russia, Turkey) are set to increase and might result in regional conflicts. Enabling market access will be crucial for solving conflicts.

Instability and intra-state conflicts in supplier countries

The decline of oil and gas prices has just begun to have an impact on resource-rich economies worldwide. So far, many producers have been able to adapt to the new situation. Minor reforms, cuts in subsidies and currency devaluation helped to overcome a first year of stagnation. However, if the situation continues or prices drop even further, the stability of many rentier economies is at stake. The danger of intra-state conflicts and regional instability is increasing drastically. First on the list are those states with high production costs, a large share of income from fossil fuel exports, and unstable political systems. This certainly applies to Venezuela, where election results are disputed and painful reforms are on the agenda for anyone who will be in charge. Nigeria is also a candidate for growing ethnic intra-state conflicts. In North Africa, Libya’s future in a low oil-price scenario might grow even more difficult than it is today. Algeria could also be affected soon, with low income from gas exports due to oil indexation. The consequences of North African uprisings some years ago might also influence regime reaction in a more restrictive way. Bigger economies such as Russia will be able to withstand a longer period of low commodity prices, but harmful spending cuts will be required here as well. In combination with Western sanctions, this could result in even more aggressive measures towards its immediate neighbors. Finally, the Arabian peninsula will be forced to reform in economic and fiscal terms. As many historic examples of economic downturn show: The search for an outside enemy could be a cover for painful domestic reform. Radicalization and polarization in the political systems are likely as well. All in all, dangerous developments for global security are looming.

The new influence of strong consumer states

A low-price environment generally tends to put more power in the hands of consumers. In terms of energy policies, the regimes of resource-rich states are in greater need of foreign support and investments, mainly to keep rentier economies running and guaranteeing future income. This is especially true for countries with a low GDP, a high share of fossil fuel exports or inaccessible deposits. Under current market conditions, it is difficult for developing states to find investors for their newly discovered oil and gas resources. International oil and gas companies are cutting back on spending and show little interest in investing in risky environments. This offers an opportunity for state-owned companies from emerging economies such as China to step in and support those regimes with loans and investments. By doing so, in a time of frailty, long-term economic and political dependencies could emerge. The case of Angola is exemplary for this. In the long run, even Brazil might use external financing to support Petro-bras in developing offshore oil exploration. Such investments create more political dependence on non-Western states, which is likely to have regional security implications. This might also be of geostrategic significance in the future, if the world moves into an era of limited availability of oil and gas again.

Traditional orders are dissolving

As this chapter has shown, traditional orders of energy relations are slowly disappearing, without clear patterns to follow. The US is close to self-sufficiency when it comes to energy supplies, while Europe is struggling to find its strategy dealing with a more complex energy world. Even more drastic are the changes on the supplier side. Today, OPEC is far away from being a cartel, it rather looks like a forum for discussion between some producer countries that has lost its political meaning. The aims and needs of OPEC members are diverging, leaving Saudi Arabia as the one single player that might have an influence on potential common OPEC action. Russia is trying to find its new position in global energy relations, being stuck between an unsatisfying endeavor towards China and a European market in harsh contrast with Russia’s market model. This whole set of divergent interests and dissolving order offers both opportunities and risks. The result of this reshuffle is hard to predict. It is clear, however, that those who are set to lose influence will not accept this silently. This mainly applies to Russia and OPEC states besides Saudi Arabia. New alliances could create tensions that might also influence stability in other policy areas.

The day after tomorrow: More uncertainty to come

For most analysts, the massive drop in fossil fuel prices over the last two years came as a surprise. Even the most sophisticated scenario did not predict this to happen. Therefore, there is a lack of recipes for dealing with the new situation. It is also very likely that this is not the end of an era of uncertainty as far as energy market developments are concerned. Relevant factors in this context could be the shift away from fossil fuels due to national climate change legislation, the lack of investment in energy infrastructure including new production sites due to low prices, as well as unexpected economic developments. A time of rocketing energy prices and scarcity in the markets could be the result within a decade. We do not know how the future of energy looks like. We do know, however, that for Europe, increasing infrastructural resilience will pay off. To that end, a time of low fuel prices might offer a window of opportunity.