Transatlantic Energy Security: On Different Pathways?

30 May 2016

By Andreas Beyer, Severin Fischer for Center for Security Studies (CSS)

This article was originally published in the CSS Analyses in Security Policy series on 15 May 2016. It is also available in German and French.

The growth of domestic oil and gas extraction has changed the role of energy in US politics. While some observers already see the US on track to becoming a geostrategic energy superpower, the EU is increasingly focusing on the security of energy supply in the context of developing an energy union.

More than any other institution, the International Energy Agency (IEA) represents a common understanding of energy policy among the member states of the Organization for Economic Cooperation and Development (OECD), which founded the IEA as a direct response to the first oil crisis of 1973. This move reflected the need for transatlantic cooperation in securing the energy supply of industrialized nations. Concerns over the potential use of energy supplies for political leverage (the “oil weapon”) caused energy issues to be viewed increasingly as part of foreign and security policy. Among the initial reactions were the creation of an IEA-controlled regime for oil stockpiling and regular mutual consultations and exchanges on energy policy and security in the framework of this forum.

In addition to a diversification of energy sources – initially, with a view to expanding the use of alternative energy sources, such as nuclear, natural gas and renewables – the demand for market-oriented and secure supply became a shared policy goal for Western states in international energy relations. The success of this partnership was manifested in the diversification of supply routes and supplier countries, the expansion of domestic extraction (for instance, in the North Sea), and – as mentioned above – the creation of the IEA as a forum for coordination among importers and a counterweight to the Organization of Petroleum Exporting Countries (OPEC). Even though the transatlantic partners did not always pursue the same policies in energy matters and especially the Western European states implemented a whole set of different strategies, they were able to rely on a common risk perception and on the willingness mainly of the US to use military force to secure open markets. The dependence on imports on both sides of the Atlantic created the basis for shared views in matters of global energy security.

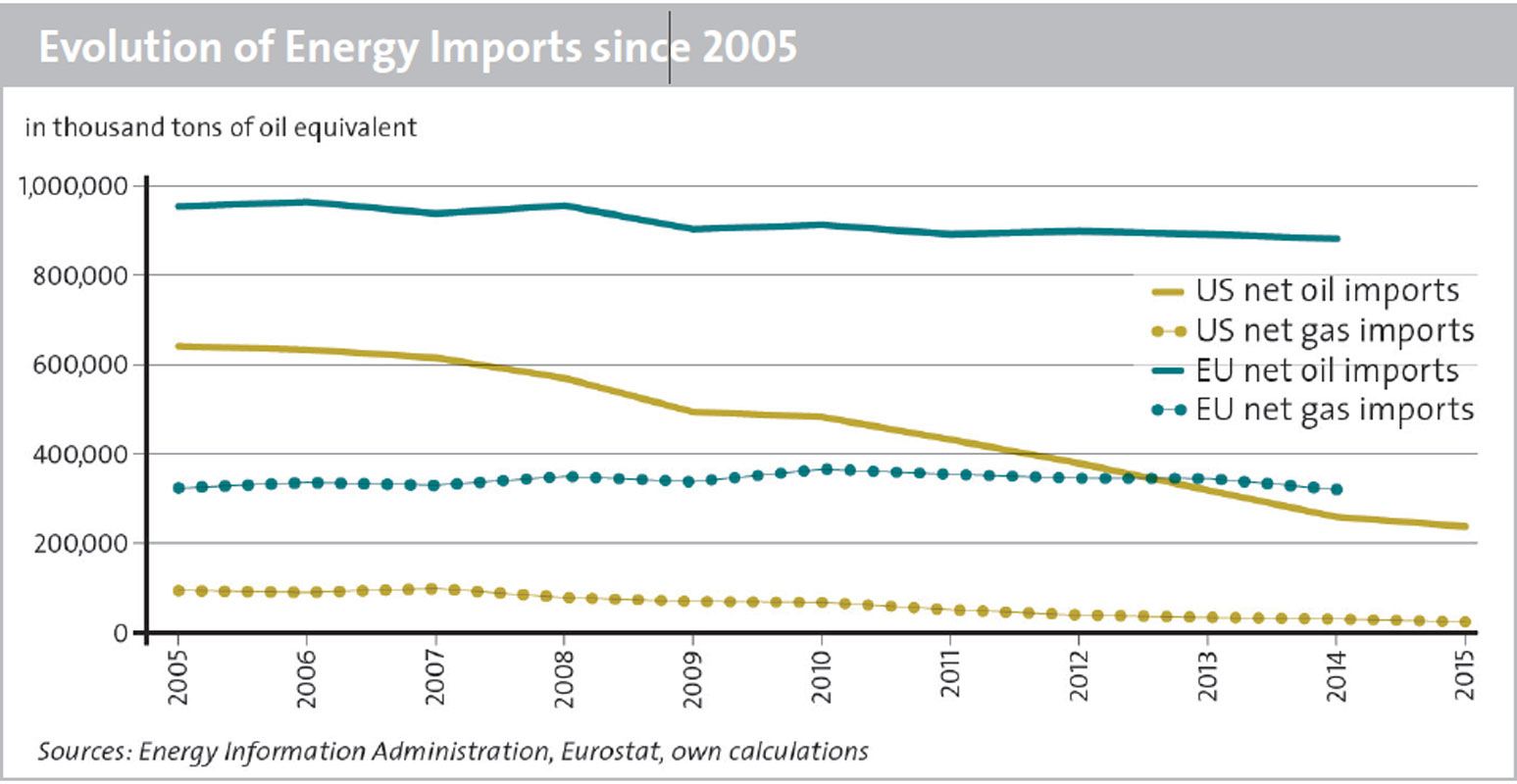

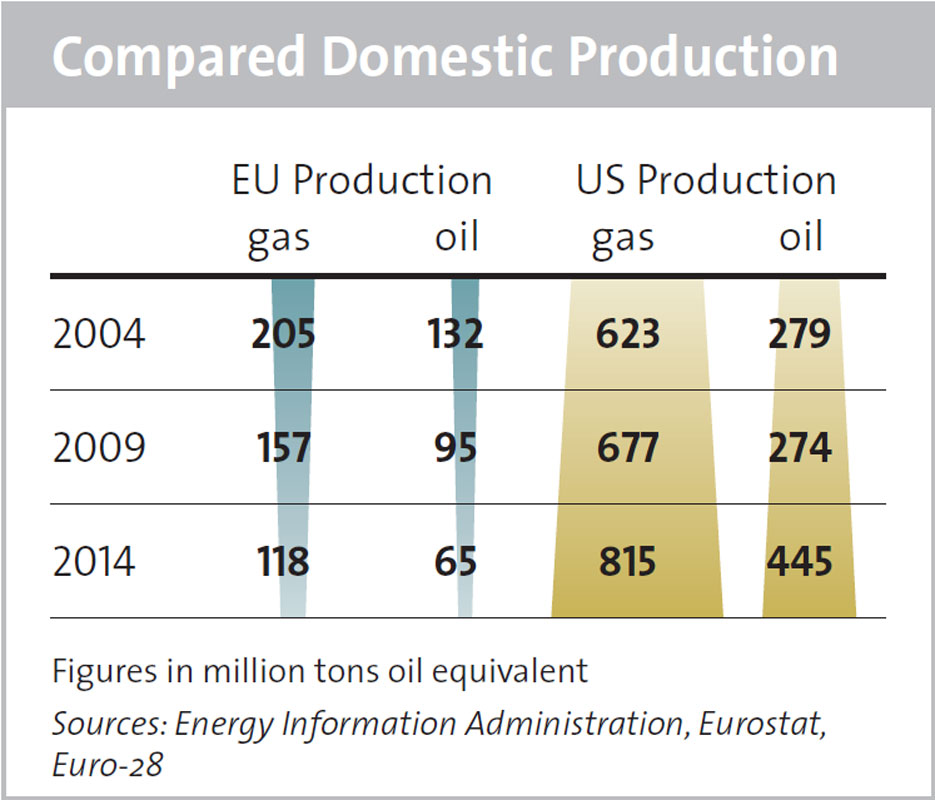

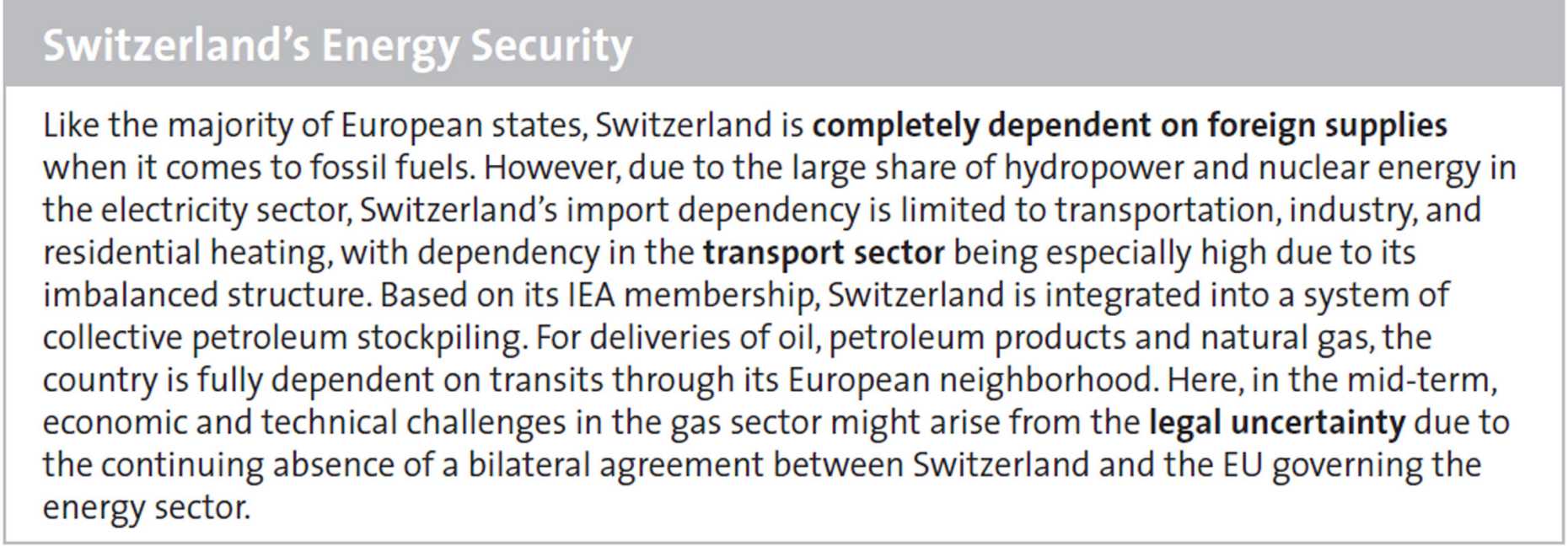

The current boom of shale gas and shale oil extraction in the US is putting this decades-old consensus to a serious test, how- ever. US energy corporations have scaled back their demand for imports on the international markets while energy companies are stepping up their roles as exporters of liquefied natural gas (LNG) and petroleum products. This has coincided with a more reticent US foreign policy under President Barack Obama. For Europe, on the other hand, the energy security situation has tended to deteriorate since the 1990s in terms of import dependency. Due to the decline in domestic production, the share of deliveries from non-EU states is increasing. The combination of a changing US foreign policy and an increasingly import-dependent EU has recently given rise to concerns in some Central and Eastern European capitals.

Among some in Washington’s foreign and security policy scene, the new framework conditions for US energy policy have already led to conceptual considerations whether their government should leverage energy exports as an additional instrument in foreign policy. Thus, Washington has abolished the export ban on crude oil and facilitated the export of natural gas. Tankers now ship US LNG across the oceans. One delivery reached European shores recently. With a rapid increase in domestic extraction, declining fuel imports, and its newfound role as an exporter of commodities, the extent of overlap with the EU’s threat perceptions seems to be on the wane. It appears that, in a new environment shaped by new technologies, more flexible energy markets, and shifting geopolitics, the transatlantic partners are searching for common interests.

Energy Union: A More Secure EU?

The vulnerability of Europe’s energy supply was never more visible than during the two oil crises of the 1970s and 1980s. Nevertheless, over the following decades, only very little integration of energy policies and no legal incorporation of energy security into the community acquis happened over the following decades. On the contrary, the European governments either sought protection under the aegis of the transatlantic security community or in the development of national strategies. Germany expanded its energy relations with the Soviet Union and Norway, the UK increased oil and gas extraction in the North Sea, and France perceived itself vindicated in its course of promoting nuclear power.

Despite these efforts at the nation-state level over the past decades, the EU today is the world’s biggest importer of hydrocarbons. About 90 percent of the oil it consumes, and 60 percent of its natural gas, are imported from non-EU states. Due to the decline of domestic extraction and the limited use of new techniques for extracting shale gas and oil deposits, one may assume that this share will further increase in the coming years. While oil imports are broadly diversified across a range of suppliers, gas imports are concentrated on Russia, Norway, and Algeria.

During the EU summit in the spring of 2007, security of energy supplies was integrated into a common energy strategy as an EU matter for the first time. One central reason behind this reorientation was the accession of Central and East European states, for whom energy policy was more of a security matter than for the former EU-15. Since the 2009 gas crisis and the peak of oil prices in 2008, the EU has shifted the focus of its energy security policy to prioritize an improvement of stockpiling oil and crisis prevention mechanisms for the gas sector as well as closer integration of the EU’s internal market. Nevertheless, corporations at the national level were largely tasked with the responsibility for security of supply, even though the EU Commission repeatedly tried to create mechanisms for Europe to intervene in the market. However, acute supply problems remained regional over the years.

With the decision to create a European energy union in 2015, the EU Commission once again emphasized security of supply in its energy policy. In view of ongoing disputes between Russia and Ukraine over transit fees and gas deliveries, the emphasis was on strengthening the infrastructure for gas, development of relations with new supplier states, and improved access to the LNG market. Notably, however, a strong focus on the gas sector remains, while energy security issues in connection with oil supplies are hardly discussed.

Even though the EU, in forming an energy union, has made another step towards integrated strategy formulation, many issues re- main unresolved when it comes to designing a coherent and consistent energy policy with a strong security of supply dimension. Among these are the future role of renewable energy and of energy efficiency in reducing dependency on imports. Central and Eastern European states in particular have either rejected steps in this direction altogether, citing cost considerations, or postponed them due to the considerable transformation efforts in the energy sector. In Western Europe, apart from the UK, the role of new extraction techniques in the oil and gas sectors is viewed with skepticism, while at the same time deliveries of LNG from such sources are welcomed. Moreover, it is completely unclear which actors are in the driver’s seat in this policy field in terms of substance and strategy: For many years the EU Commission supported a model of enabling a more and more integrated European market to ensure security of supplies. In recent years, however, its strategies have put more emphasis on geopolitical considerations and regulatory intervention. For instance, it pushes for Europe to wean itself off Russian gas imports and provides financial support for the construction of LNG terminals through public investment. The stronger regulatory-interventionist approach is also highlighted in the proposals for a new regulation on gas security, which is to make market interventions by member states and the EU Commission easier.

At least at the conceptual level, the EU Commission and member state governments have responded to the community’s growing dependence on imports with the formation of the energy union. In addition to the decarbonization strategy, which is a matter of controversy among some member states, the gas sector in particular has been identified as a core area of action. Although a nascent conflict in the gas sector over models and jurisdictions between the levels of market and state intervention on the one side and between the EU and its member states on the other side may be discerned here, the oil sector so far remains largely excluded from the security strategy of the energy union.

The US: An Energy Superpower?

US energy policy has undergone a fundamental change in the past ten years due to the unexpected boom of domestic oil and gas extraction. In previous years, discussions had been dominated by concerns over dependency on imports; currently, the main questions are related to how the nation should handle its own exports of commodities, as well as the new position of power in which some actors from Washington’s foreign policy community see themselves. A more differentiated picture emerges, however, if we take a closer look at the supply structures. While the US situation has certainly changed, energy policy is neither a suitable instrument of geopolitics, nor is energy autarky an attainable goal in the middle term.

First of all, the US remains dependent on energy imports for the foreseeable future. Any impending US “energy autarky” exists only on paper, based on a superficial summation of deliveries. Most analyses dealing with this topic fail to take into account differences regarding the extraction of commodities as well as the established supply and value creation chains with their attendant infrastructure. Despite the extraction boom, it has not been possible to completely transform the supply infrastructure, which was built over decades with a focus on imports and includes specific processes for distribution and processing. For instance, an insufficient transport infrastructure limits the possibility of exporting oil from domestic production in the Gulf of Mexico. New gas terminals, pipelines, and rail transport capacities have yet to be built. In this situation, the transformation of the US energy system is reaching infrastructural limits.

Secondly, the US shale oil and shale gas corporations face an uncertain economic future. Since energy and commodity markets are volatile and inelastic, supply and demand are brought into equilibrium by large price fluctuations: If the supply of commodities increases rapidly, as is currently the case, demand does not automatically keep pace. As a result, prices drop commensurately. Conversely, if demand increases, supplies do not grow at the same rate; new oil and gas fields must first be explored and developed. As a result, energy prices increase substantially. It is in this difficult market environment that the shale oil and gas industry must assert its mid- to long-term position. The high cost of developing new oil and gas fields and the growing debt ratio currently still forces US companies to extract and market their products. A critical factor for their survival is the question of how long the current phase of depressed prices will continue. Many companies would be able to extract resources profitably if prices were to rise; on the other hand, if that does not happen, they might lose capacities and jobs. A recovery might take years. In any case, a linear continuation of the current extraction boom in the US appears out of the question.

Third, notions of politicizing the international system of energy delivery systems and of energy autarky are primarily populist electioneering soundbites on both sides of the political spectrum in the US. A common element of these campaigns is a tendency to depict energy import-related dependency and vulnerability in dramatic terms and an excessive emphasis on the state’s ability to intervene. The increased domestic extraction of fossil fuels in recent years has been not so much the result of targeted energy policy strategies, but rather the interplay of market and technology factors intersecting with an investment-friendly regulatory environment. Thus, the US was able to overcome the perceived political dependency on energy exporters. It is doubtful whether Washington will be able in a second step to leverage energy deliveries for its own foreign policy. The possibility cannot be ruled out that certain market developments may coincide with exports to regions that the US views as being of geostrategic relevance for its foreign and security policy. However, it is not very likely that any kind of “strategic energy policy through commodity deliveries” can be implemented as part of the country’s foreign policy. There is no state-owned US energy corporation that could serve as a direct instrument of such a policy. Moreover, in the US, regulatory jurisdiction over energy policy is distributed between authorities at the federal and at the state levels. This has already impeded the formulation and implementation of coherent energy-policy goals in the past.

In the US, all of these factors coalesce to create tension between the rather abstract concerns over security of supply, the new self-image emanating from the oil and gas extraction boom, and the actual freedom of action that the government enjoys. Free trade routes for energy have always been se- cured by the unchallenged dominance of the US Navy; there has never been the slightest possibility of a material embargo directed against the US. Furthermore, unlike in emerging markets, rising energy prices and import costs can never bring about a balance-of-payments crisis in the US. Washington is the issuer of the US dollar – the global trade and reserve currency; as such, energy imports can never be under threat from a lack of hard currency. Accordingly, the recurring discussions over energy security and autarky should be attributed to their popularity as campaign issues rather than to real-life strategic vulnerability. This already became especially apparent during the oil crises: Although citizens, the media, and politicians on both sides of the Atlantic perceived themselves at least temporarily as being impotent in the grip of petroleum- exporting nations, there were no physical disruptions of deliveries for importers. The international oil companies simply re-routed deliveries accordingly. Thus, even back then, rhetoric and perceptions of vulnerability were decoupled from reality. However, until this day, such a crisis-narrative constitutes a foil for slogans and comments, but not for concrete political substance.

Effect on Atlantic Cooperation

The EU-US Energy Council, created in 2009, serves as a bilateral forum for consultations and cooperation on energy and energy security strategies. While the climate policy induced transformation of energy systems, and the collaboration on the development of new technologies has proven to be a promising field of cooperation transatlantic cooperation in matters of energy security has made hardly any progress. It is noticeable, however, how much this forum has focused, most recently in particular, on issues related to the security of European gas supplies. The joint statement from May 2016 shows clearly, how much the US side is pushing for its foreign policy and trade-related interests to be taken into consideration in the energy sector; based on its critical stance vis-à-vis Russia, it prioritizes a strengthening of the Ukrainian transit corridor and support for Central and Eastern European LNG imports. The EU side has recently given particular preference to state intervention in energy policy through strategic investments, welcomes LNG imports from the US, and strongly supports a dedicated energy chapter in the negotiations about the Transatlantic Trade and Investment Partnership (TTIP).

Two conclusions may thus be inferred regarding the respective positions of the two partners when it comes to energy security policy and the further development of relations between them: On the US side, the relevance of global energy security strategies, which so far have been regarded as directly tied to the securing of US energy supplies, is declining at the political level. As a result, Washington’s general foreign- policy preferences are being emphasized more explicitly within the existing cooperation models for energy policy. Examples include the offer of supplying Central and Eastern European countries with LNG or demands for state intervention in determining the course of pipelines. Especially LNG exports to Europe could turn out to be a false promise since neither competitive prices nor a long-term perspective for exports can be guaranteed from the US side. Accordingly, the competition-oriented domestic perspective of US energy policy is reflected less strongly in the rather geopolitical alignment of foreign (energy) policy. Within the EU, too, the competitive approach is increasingly being challenged when it comes to the security of gas supplies. Here, however, the domestic perspective of the energy union is more immediately affected. The key question is whether a perceptible involvement that relies more on geopolitical considerations and state intervention than on markets does indeed serve the interests of European security of supply.

Thus, as actors on both sides of the Atlantic – with different motives and differing perspectives – engage more closely with matters of regional security related to European gas supplies, crucial global changes in the oil markets are receding into the background. However, these are likely to play an important role for both sides in the future, especially for the EU with its volatile neighborhood. Issues such as how to deal with increasingly unstable regimes in supplier states, or precautionary measures in the face of a possible investment backlog in the oil industry due to the current price slump, could become more relevant in the near future.

About the Authors

Andreas Beyer is a researcher and PhD student at the Institute for Security Policy at Kiel University (ISPK).

Dr. Severin Fischer is a Senior Researcher at the Center for Security Studies (CSS) at ETH Zurich. He is the author of several publications, including Auf dem Weg zur gemeinsamen Energiepolitik (2011) and An Energy World Order in Flux (2016).

Most recent issues: